ABSTRACT

To help alleviate poverty, Thailand created the Village and Urban Community Fund (Village Fund). To determine whether the Village Fund has been able to reach the truly poor, this paper applies a Logit model, using data from Thailand’s Socioeconomic Survey at the household level in 2009, to investigate the determinants of borrowers and whether being poor is significant for borrowing from the Fund. Our analysis reveals that The Village Fund targets near-poor and moderate-income households, not the poor. The Village Fund cannot be said to be pro-poor. However, the program has its merits, particularly in lending to women and less-educated heads of households. For near-poor households, the most likely borrowers are farmers, especially landless farmers in rural areas with income slightly above the poverty line. For moderate-income households, the most likely borrowers also have access to other sources of credit. While not directly pro-poor, the Village Fund, in lending to near and moderate-income groups, helps them avoid falling into poverty.

Keywords: Microcredit, Village fund, Urban community fund, Rural development, Poverty reduction.

INTRODUCTION

background

Microcredit – programs that provide small loans for self-employment and consumption to the poor, especially women without access to formal financial services – is a popular tool for poverty alleviation in develop- ing countries, such as Bangladesh, Bolivia and Indonesia. Microcredit- it grew significantly in the 1990s (Robinson, 2001). In 1997, the first Microcredit Summit took place in Washington, D.C., with more than 2,900 delegates from 137 countries participating. The conference committed to reach the world’s poorest families with microcredit. Later, the United Nations declared 2005 the “International Year of Microcredit” and linked microcredit to the achievement of the Millennium Development Goals (MDGs), including reaching 175 million of the world’s poorest families with credit for self-employment and other finance and business services and helping to raise 100 million families above the US$ 1 a day threshold by 2015. In 2006, Muhammad Yunus, the founder of the Grameen Bank, received the Nobel Peace Prize for his efforts to create economic and social development from the bottom up, increasing microcredit’s visibility even further. Microcredit reached one hundred and fifty million individuals worldwide in 2007 (Daley-Harris, 2009).

Most microcredit programs state that their primary mission is to alleviate rural poverty by delivering credit and other financial services to poor households. Khandker (2005) found that microcredit reduced poverty in Bangladesh, as the poor borrowed for income-generating activities, education and health, all of which significantly increased well-being. Mi- microcredit resulted in local economic growth, as well. Microcredit programs, originally designed to serve the un-banked poor, are important tools for poverty reduction.

In Thailand, government has supported microcredit programs for more than 30 years. Most of the programs developed from community-based credit schemes that focused on social capital in the community (Worakul, 2006). In 2001, the Thai Government created the Village and Urban Community Fund as part of its poverty alleviation policy. It is the largest government microcredit program in Thailand, with THB 1 million allocated per village.

Empirical studies have shown the positive effects of microcredit. For example, microcredit can raise household income and reduce poverty (Berhane & Gardebroek, 2011; Nader, 2008; Khandker, 2001) and can improve household consumption such as health and education (Coleman, 1999; Nader, 2008). However, not everyone can or does access the programs, with considerable debate as to who really benefits – the poor or non-poor – from microcredit programs like the Village Fund. While many studies have shown that microcredit benefits poor households (Boonperm et al., 2009; Khandker, 2005), some studies argue that non-poor households and wealthier villagers are more likely to receive loans (Coleman, 2006; Li et al., 2011; Suriya, 2011).

This question – who benefits? – leads to the research questions in this study: What are the determinants of borrowers in the Village Fund? Are poor households included in the Village Fund program? The answer will help the Thai government improve the program to be more effective at reaching the poor and reducing poverty.

The Village and urban Community Fund in Thailand

The Village and Urban Community Fund, the largest government microcredit program in Thailand, has been operational since 2001. The Village Fund is a populist policy that has created political support for the Thai Rak Thai Party. The government revolutionized the local credit market by allocating THB 1 million (about USD 22,500 at the average exchange reat of USD 1 = THB 44.5 in 2001) per village to over 77,000 villages and urban communities throughout the country. The program is a semi-formal financial institution, and the second-largest microfinance program in the world (Boonperm et al., 2012), contributing approximately 1.5 percent to Thai GDP in 2001 (Kaboski and Townsend, 2009). After the general election in 2011, the government increased the Village Fund allocation to THB 2 million (about $65,800 at the average exchange rate of USD 1 = THB 30.4 in 2011) per village. As a result, this program is highly important in credit markets, especially in rural areas and for people who cannot access formal financial services.

The Village and Urban Community Fund operates under the philosophy of values and wisdoms of local communities. The focus of the Village Fund program is on community empowerment and self-reliance, which is based on flexible and adjustable rules that meet the community’s needs. It links public, private and civil society to develop the rural economy through the credit market and awareness in local communities. The official objectives of the Village Fund, according to the “Act of National Village and Urban Community Fund (B.E. 2547)” of 2003, are as follows:

- Provide loan funds for investment, job creation, income generation, welfare improvement and expense reduction.

- Provide emergency funds.

- Provide deposit services for members.

- Supply loans to other village funds for economic and social strengthening.

- Develop the rural economy.

The central regulation states that loans cannot exceed THB 20,000 per borrower (increased to THB 30,000 in 2011). In some cases, this can be extended to THB 50,000 (increased to 75,000 in 2011). Emergency loans cannot exceed THB 10,000 (increased to 15,000 in 2011). The interest rate must not exceed 15 percent per year. The repayment has to be made within one year (increased to two years in 2008). Repayment must be guaranteed by at least two persons. A borrower will receive the money and repay the debt via the Bank for Agriculture and Agricultural Cooperatives (BAAC) or the Government Savings Bank (GSB).

The Village Fund is administered at two levels. First, at the national level, the National Committee of the Central Government, including 76 provincial and 928 district sub-committees, oversees the Village Fund. Second, at the village level, local committees consist of 9 to 15 members elected from villagers who have lived in the village for at least two years. Half of the local committee members must be women. The local committees establish the regulations, rules and procedures concerning the management of their own funds. The local committee also decides who receives the loans. The primary loan conditions include a member’s ability to repay, the purpose of borrowing and the loan size. The close relationship between the local committee and its members reduces risk, because they know each other. In particular, the committee is able to identify the risk of each borrower and his or her ability to repay the loan (Boonperm et al., 2009; Kaboski & Townsend, 2009; Menkhoff & Rungruxsirivorn, 2011).

Determinants of microcredit borrowers

Previous empirical studies have analyzed the factors that affect household participation in microcredit. Households and individuals with similar characteristics – e.g., age, education, household size and in-come – might have different levels of entrepreneurial spirit or ability. These may lead to a difference in probability to borrow. For example, Evans et al. (1999) presented a conceptual framework of barriers to participation in the microcredit program in Bangladesh. Program-related barriers, such as membership requirements, and client-related barriers, such as health, household size, dependency ratio, income and assets of households, were taken into account. The study found that determinants of borrowers were gender, education, household size and land ownership. Khandker (2001, 2005) examined determinants of participation in microfinance programs in Bangladesh; the results showed that resource-poor households, both in landholding and formal education, demand more loans from microfinance programs than resource-rich households. This means the landless households were likely to receive more loans from microfinance programs than landed households.

In a study of financial exclusion in Canada, Simpson and Buckland (2009) concluded from Probit that unbanked households had lower in-come, wealth and education. They were older, more likely to have a larger family with fewer earners and more likely to have a lone parent with children aged 5-17 years old. Blasio and Nuzzo (2010) used data from an Italian survey of household income and wealth to identify determinants of social behavior. Their results suggested that age, sex, education, employment, homeownership and urban residence were determinants of participation in groups and associations.

In addition, Li et al. (2011) conducted an empirical study to investigate the accessibility to microcredit of rural households in China. The analysis, which was based on the Logit model, showed that the demographics and socio-economic characteristics of rural household, such as income, dependency ratio, location of household, access to other credit sources and attitude towards debt, were determinants of the access to microcredit. Supply-side factors such as interest rate and loan processing time were also determinants. While they found that microcredit programs improved household income and consumption, the main beneficiaries in China were non-poor households. They also concluded that the significant impacts of microcredit on increasing household welfare did not necessarily mean that microcredit reduced poverty, since the programs did not target poor populations.

In Thailand, Coleman (2006) investigated the determinants of village bank members in Northeast Thailand. He used a Logit model to analyze whether household characteristics and credit worthiness scores influenced the decision to be members, and found that credit worthiness scores, value of land owned by women and female household heads were significant determinants. Moreover, results indicated that wealthier villagers are significantly more likely to participate than poorer ones.

In previous studies, Chandoevwit and Ashakul (2008) and the World Bank (Boonperm et al., 2009) evaluated the Village Fund’s impact. They used household variables to construct the propensity score to match the non-participants with household characteristics similar to those who participated in the Village Fund. They included characteristics of both the household head (including gender, age, status and education) and household (in- including size, number of income earners, marital status, assets and main sources of household income). Menkhoff and Rungruxsirivorn (2011) compared characteristics of borrowers between the Village Fund and six other financial institutions in three provinces in Northeast Thailand using Multinomial Logit.

They found that age, female household head, number of children, occupation, income, assets, landholding, ratio of defaulted loan and loan characteristics were determinants of the decision to choose the source of loans.

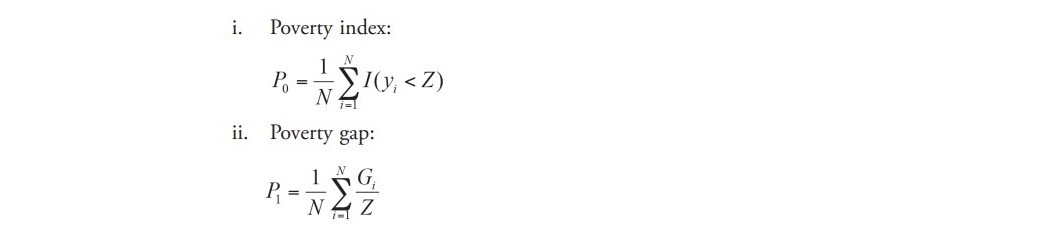

According to the World Bank, the impact of Village Fund borrowing is strong for the poorest quintile and they categorize the Village Fund as pro-poor policy (Boonperm et al., 2009). Suriya (2011) pointed out from the survey data of a village in northern Thailand that most of the poor households reached the loan limit because they did not payback previous loans, making them ineligible for new credit. Only the richest or second richest quintiles of households in a village were capable of applying for microcredit. This current paper tries to answer who benefits from the Village Fund by including household head characteristics, demographics, socio-economic occupations, income and assets and other related factors as control variables to test the significance of the determinants of borrowers. It also includes a poverty index, poverty gap and interaction term of being poor without access to other credits as key testing variables to test the significance of the accessibility to the Village Fund by the poor households. The extent of poverty of this study follows the Foster-Greer-Thor- becke (Foster et al., 1984) concept, which measures poverty as follows:

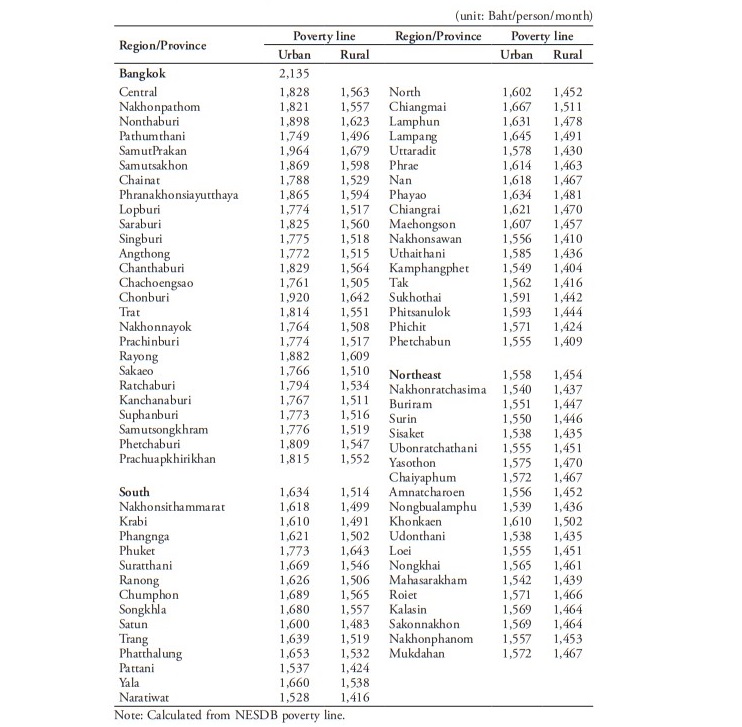

where I(.) is an indicator function that can be set to 1 if the bracketed expression is true, and 0 otherwise. yi is the average monthly consumption expenditure per capita, including food, beverages, tobacco and other good and services. Gi = (Z – yi).I(yi < Z) and Z are the poverty lines in 2009 (National Economic and Social Development Board of Thai-land (NESDB), 2012). The decomposition of the lines for particular provinces were calculated (Appendix A).

METHODOLOGY

The Logit model

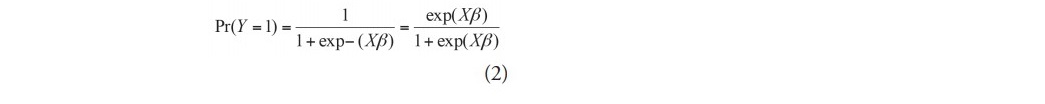

Logit is frequently used for cases in which the dependent variable is binary. It assumes the logistic distri- bution of the error term and provides a good estimator, which is both con- sistent and efficient (Maddala, 1983; Li, et al., 2011). This paper chooses Logit over Probit because it is more convenient to read its coefficients as the log of odd ratio and easier to see the marginal effects (Suriya, 2011). In addition, when the sample size gets large, the results from Logit and Probit will be very close (Maddala, 1983).

Logit is commonly used to exam- ine household accessibility to credit (Li et al., 2011). The household chooses to borrow when utility of borrowing exceeds utility of not borrowing and their difference depends upon a vector of household characteristics (X). Let be the probability that a household chooses to borrow from the Village Fund, it can be written as:

Pr(Y = 1) = ƒ ( X ) (1)

This paper uses the observed infor- mation of household choice (borrow or not borrow) and household char- acteristics to estimate the probability of the household choice, conditional on the household characteristics using the Logit model. The empirical model can be expressed as follows (Maddala, 1983):

It is clear that the dependent variable, Y, is binary choice, with a borrower from the Village Fund program classified as one, otherwise it is zero. Explanatory variables, X, is a vector of household characteristics including household head characteristics, demographics, socio-economics class, income and assets and other variables.

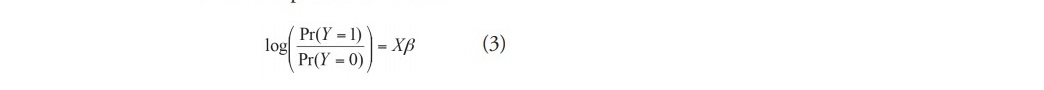

Equation (2) represents the cumulative logistic distribution function in a non-linear form. For the purpose of interpretation, its coefficients can also be read as the log of odd ratio (Madd- ala, 1983). With a transformation, the estimated model becomes a linear function of the explanatory variables, which is expressed as follows:

where the parameters, , is a vector of coefficients for the explanatory variables. It will be estimated by maximum likelihood.

Data collection

The data in this study are from the Thailand Socioeconomic Survey in 2009 conducted by the National Statistical Office, Ministry of Information and Communication Technology. The survey interviewed 43,844 households (both borrow-er and non-borrower) throughout the country. Since 2009, the survey includes a section on Village Fund participation. The key question is, “During the previous year, did any household members have debt from the Village and Urban Community Fund?” This question allows for separating the data into borrowing households (one or more members having borrowed from the Fund) and non-borrowing households (no members borrowing from the Fund). The data were collected monthly. The survey collected a variety of household socio-economic data including detailed information on household income and expenditure. For this study, households with incomplete data were dropped, leaving a sample size of 41,296 households.

RESULTS

Household characteristics

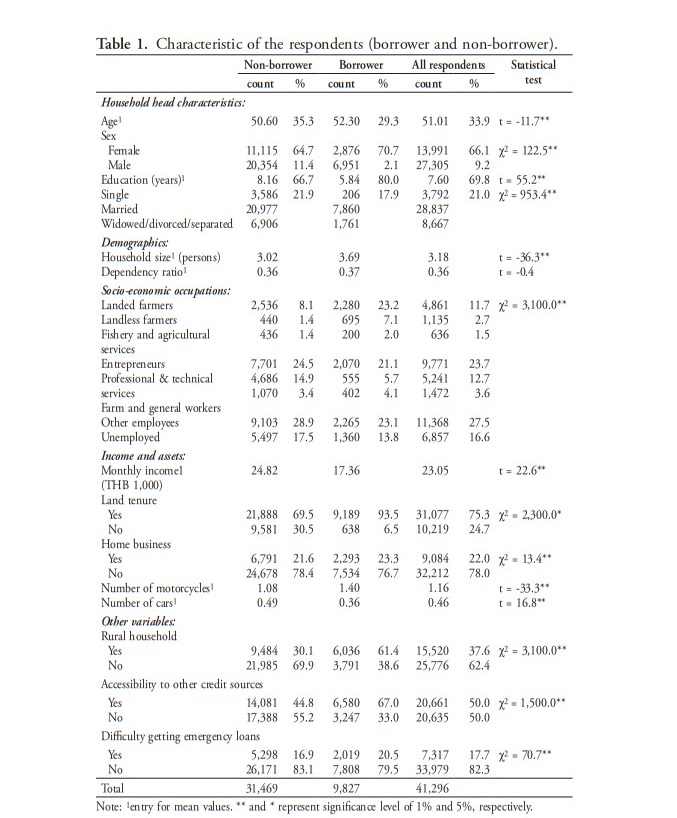

Out of 41,296 samples, 9,827 households borrowed from the Village Fund. The average loan size was THB 16,148. The mean annual interest rate was 6.0 percent. Around 40 percent of borrowers used the loan for farm-related business. Only 17 percent used it for non-farm business. Six percent of borrowers used the loan for refinancing or house improvements. More than seven percent of borrowers were overdue on their repayments. Table 1 summarizes the household characteristics. A t-test determined whether the mean values of household variables between borrower and non-borrower were statistically different. Chi-square tested the relationships between the groups of household variables and the borrowing. The t-test results were statistically significant at the 99 percent level, except for the dependency ratio. This demonstrates that the mean value of age of household head, household size and numbers of motorcycles in borrower households are significantly higher than non-borrower households. Education of household head, household monthly income and numbers of cars in borrower households have less mean value than that of non-borrower households.

table 1. Characteristic of the respondents (borrower and non-borrower).

Borrower households are strongly associated with women, marital status, socio-economic occupations, land tenure, home business, rural household, accessibility to other sources of credit and difficulty getting emergency loans (chi-square tests on these variables significant at the 99% level). Eighty percent of the borrowers and two-thirds of the non-borrowers were married. Just over two percent of the borrowers were single, much low- er than for non-borrowers (11.4%). The chi-square test in Table 1 indicates a strong association between borrowing and socio-economic occupations. Of the respondents, 27.5 percent relied on employment in the commercial, service, production and construction sectors, while 23.7 percent worked in the business, trade, industry and service sectors. For the agricultural sector, 15.9 percent of the respondents were engaged as landed farmers, landless farmers or fishery and agricultural services. The results also suggested that borrowers were more likely engaged in agriculture than non-borrowers (32.3% versus 10.9%). Professional, technical and managerial services respondents were usually clients of formal financial institutions, with a higher ratio of non-borrowers (14.9%) than borrowers (5.7%).

Borrowers were more likely to own houses or land (93.5%). They also used their home for business purposes more than non-borrowers (23.3% versus 21.6%). However, non-borrowers had higher monthly income (THB 24.82 thousand per household) than borrowers (THB 17.36 thousand per household).

The majority of borrowers (61.4%) lived in rural areas while the majority of non-borrowers (69.9%) lived in urban areas. Borrowers had better access to alternative credit sources (67.0% versus 44.8%). For emergencies, borrowers had more difficulty accessing loans (20.5% versus 16.9%).

Determinants of borrowers of the Village Fund

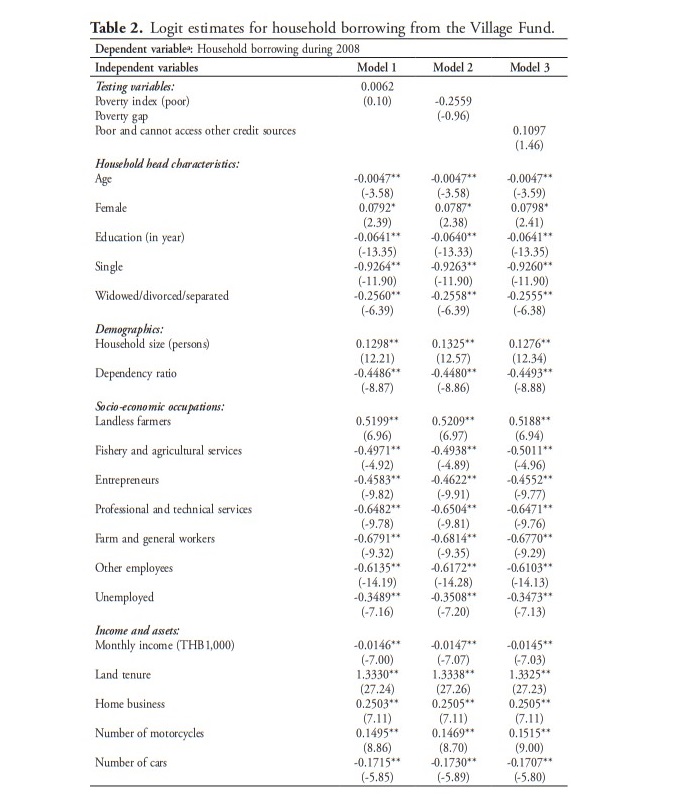

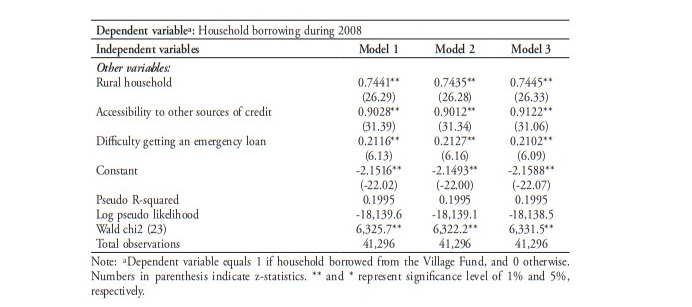

The testing variables for this study are the poverty index, poverty gap and an interaction term, which shows the poor households who cannot access other credit sources (microcredit’s target group). To avoid multicollinearity among the poverty index, poverty gap and their interaction, we use three models to test the different variables as shown in Table 2. The Logit model successfully predicted the probability of borrowers in all three models. It rejects the null hypothesis

that the parameters estimated in the model equal to zero at the 99 percent level of significance. It can be concluded that the explanatory power of the Logit model is satisfactory and the model can explain the probability of borrowers.

The primary goal of most microfinance programs, including the Village Fund, is to alleviate rural poverty by delivering credit and other financial services to poor households. All three models showed that being poor was not a significant determinant for borrowing from the Village Fund (Table 2). The results indicated the failure of microcredit to include the poor, especially those who could not access other credit sources.

For other borrower characteristics, the results showed that households with younger female heads were more likely to borrow. Less educated household heads were also more likely to borrow. The significant negative signs on marital status indicated that single, widowed, divorced or separated household heads were less likely to borrow than married ones. In turn, a larger household with less dependency ratio was more likely to borrow from the Village Fund.

Dummy variables for household occupations concluded that farm- operating household tended to have a higher probability to be a borrower. The effect is more pronounced for landless households (rented the land). The near-poor households, the households with low income but above the poverty line, borrowed from the Village Fund. Assets of household assets were determinant for borrowing. Homeownership increased the probability to borrow. Furthermore, households that used their home for business purposes were more likely to borrow. In terms of vehicle ownership, households with a high number of motorcycles was more likely to borrow, while households with high number of cars was less likely to borrow.

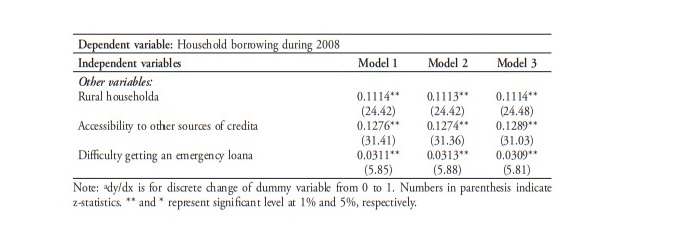

Rural households tended to be clients of the Village Fund. Moreover, households with access to other sources of credit, but difficulty getting emergency loans, were more likely to borrow.

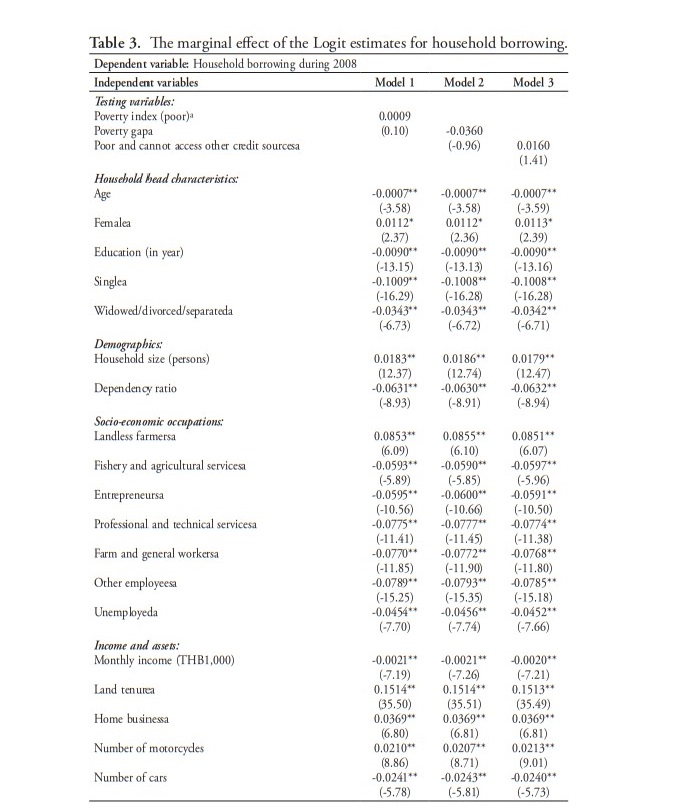

Table 3 summarizes the marginal effect of the Logit model, providing the direct effect of the explanatory variables on borrower household characteristics. For example, the marginal effect of age indicated that an increase in age of the household head decreased the probability of borrowing by 0.07%. For each additional household member, the probability of borrowing increased by 1.83% on average. If a female household head, the probability increased 1.12% on average; if a landowner, 15.14%; if access to other credit sources, 12.80%; and if a rural household, 11.14%.

DISCUSSION

Non-poor households, especially near poor and moderate-income groups, accessed the Village Fund more than the poor households (as shown in Table 2). These findings confirm empirical evidence previously reported by Anuchitworawong (2007). Although some of the poor households reported that they chose not to borrow from the Village Fund, many others were excluded against their wishes because the committee or a personal guarantor felt they could not repay the debt.

The results showed that female borrowers, who the local committees felt were lower credit risks, had a higher chance of borrowing. The finding that single, widowed, divorced and separated household heads had a lower probability of borrowing from the Village Fund is consistent with Coleman (1999), who studied group lending in Thailand. Coleman (1999) argued that these categories were viewed as lacking creditworthiness and their households appeared un-stable.

Households with more members had a higher probability of borrowing from the Village Fund as they had more income sources and, as a result, are more capable of repaying debts. Households with a high dependency ratio tended to borrow less from the Village Fund. These households allocated money to take care of children, the elderly and disabled, possibly affecting their ability to repay the loans.

Farmers were the primary borrowers of the Village Fund. One explana- tion is that rural farm households were familiar with the financial system, through loans offered by the Bank for Agriculture and Agricultural Cooperatives (BAAC). Moreover, other occupations had easier access to other financial services, such as bank and non-bank personal loans.

Although poor versus non-poor households was not a determinant for borrowing from the Village Fund, the results showed that near poor household, lower-income household with income above the poverty line, were more likely to be borrowers. As found by Menkhoff and Rungrux- sirivorn (2011), the Village Fund reached lower income households, while commercial banks appeared to serve households with higher income.

Home ownership was associated with Village Fund borrowing. This confirms the suggestion from Grameen Bank in Dowla (2006) that, ...A house is like a factory build- ing where all household-based production occurs and as such owning a house is an important input of production.

Households with higher number of motorcycles were more likely to borrow.

Although the Village Fund loaned money throughout Thailand, rural households were more likely to borrow. Furthermore, accessibility to other formal, semi-formal and informal sources of financial institutions also increased the probability of borrowing.

Households that had difficulty getting an emergency loan were able to borrow from the Village Fund, achieving one of the Fund’s objectives. The principle of microcredit programs to fight against poverty focuses on providing loans to the poor. How- ever, the Village Fund, the largest government microcredit program in Thailand, differs from those micro-credit programs. The Fund does not claim to target the poor, but instead to provide a new source of financing for rural and urban community members with limited or no access to other funding sources.

REFERENCES

Anuchitworawong, C. 2007. Credit Access an Poverty Reduction. TDRI Quarterly Review 22(4), 15-21.

Armendáriz, B., and M. Labie. 2011. Introduction and Overview: An Inquiry into the Mismatch in Microfinance. In B. Armendáriz & M. Labie (Ed.). The Handbook of Microfinance. pp. 3-13. Singa- pore. World Scientific.

Blasio G., and G. Nuzzo. 2010. In- dividual determinants of social behavior. Journal of Socio-Econo- mics 39(4), 466-473. 10.1016/j. socec.2010.03.001

Berhane, G., and C. Gardebroek. 2011. Does Microfinance Reduce Rural Poverty? Evidence Based on Household Panel Data from Northern Ethiopia. American Journal of Agricultural Econom- ics 93(1), 43-55. 10.1093/ajac/ aag126

Boonperm, J., J.H. Haughton, and S.R. Khandker. 2009. Does the Village Fund Matter in Thailand? Policy Research Working Paper 5011, The World Bank.

Boonperm, J., J. Haughton, S.R. Khandker, and P. Rukumnuaykit. 2012. Appraising the Thailand Village Fund. Policy Research Working Paper 5998, The World Bank.

Chandoevwit, W., and B. Ashakul. 2008. The Inpact of the Village Fund on Rural Households. TDRI Quarterly Review 23(2), 9-16.

Coleman, B.E. 2006. Microfinance in Northeast Thailand: Who benefits and how much? World Development 34(9), 1612-1638. 10.1016/j.worlddev.2006.10.006 Coleman, B.E. 1999. The impact of group lending in Northeast Thailand. Journal of Development Economics 60(1), 105-141.10.1016/s0304-3837(99)00038-3

Daley-Harris, S. 2009. State of the Microcredit Summit Campaign Report 2009. Microcredit Summit Campaign, Washington, DC. Dowla, A. 2006. In credit we trust: Building social capital by Grameen Bank in Bangladesh. Journal of Socio-Economics 35(1), 102-122.10.1016/j.socec.2005.12.006

Evans, T.G., A.M. Adams, R. Moham- med, and A.H. Norris. 1999. Demystifying Nonparticipation in Microcredit: A Population-Based Analysis. World Development 27(2), 419-430. 10.1016/s0305-750x(98)00134-x

Foster J., J. Greer, and E. Thorbecke. 1984. A Class of Decomposable Poverty Measures. Econometrica, 52(3), 761-766.

Kaboski, J.P., and R.M. Townsend. 2009. The Impacts of Credit on Village Economies. MIT Department of Economics Working Paper No. 09-13. Available at SSRN: http://ssrn.com/ab- stract=1395348

Khandker, S.R. 2001. Does Microfinance Really Benefit the poor? Evidence from Bangladesh. Paper presented at Asia and Pacific Forum on Poverty: Reforming Policies and Institutions for Poverty Reduction. Manila.

Khandker, S.R. 2005. Microfinance and Poverty: Evidence Using Panel Data from Bangladesh. The world Bank Economic Review 19(2), 263-286. 10.1093/wber/ihi008

Li, X., C. Gan, and B. Hu. 2011. Accessibility to microcredit by Chinese rural households. Journal of Asian Economics 22(3), 235-246. 10.1016/j.asieco.2011.01.004

Maddala, G.S. 1983. Limited-dependent and qualitative variables in econometrics. Cambridge: Cam- bridge University Press.

Menkhoff, L., and O. Rungrux- sirivorn. 2011. Do Village Funds Improve Access to Finance? Evidence from Thailand. World Development 39(1), 110-122. 10.1016/j.worlddev.2010.09.002

Nader, Y. F. 2008. Microcredit and the socio-economic wellbeing of women and their families in Cairo. Journal of Socio-Economics 37(2), 644-656. 10.1016/j. socec.2007.10.008

Thailand Socioeconomic Survey in 2009 conducted by the National Statistical Office, Ministry of Information and Communication Technology.

National Economic and Social Development Board of Thai- land. 2012. Provincial Poverty Line in 2009. Retrieved July 19, 2012, from http://social.nesdb. go.th/SocialStat/StatReport_Fi- nal.aspx?reportid=448&tem- plate=2R1C&yeartype=M&sub- catid=60

National Statistical Office, Ministry of Information and Communication Technology. 2011. Household Socio-Economic 2009 [Data file].

Robinson, M.S. 2001. The Microfinance Revolution: Sustainable Finance for the Poor. Washington, D.C., The World Bank.

Simpson W., and J. Buckland. 2009. Examining evidence of financial and credit exclusion in Canada from 1999 to 2005. Journal of Socio-Economics 38(6), 966-976. Suriya, K. 2011. An Economic Analysis of Community-based Tourism in Thailand. (Doctoral dissertation) Faculty of Economic Sciences, Georg-August University of Goettingen.

Verbeek, M. 2004. A guide to modern econometrics. England, John Wiley & Sons Ltd.

Worakul, W. 2006. Community-Based Microfinance: An Empowering Approach Towards poverty Alleviation and Community Self- Reliance. UNDP Thailand.

APPENDIX A

Decomposition of the provincial poverty line in 2009