ABSTRACT

This article uses quantitative methods to achieve two objectives: assessing the needs of and creating suitable and appropriate guidelines for promoting financial wellbeing of households in Bang Kruai district, Nonthaburi province, Thailand. The sample group provided with questionnaires consisted of 400 representatives of households, obtained by multi-stage sampling. The statistics used for data analysis were descriptive statistics such as frequency, percentage, Mean, standard deviation and the priority need index (PNI modified). We found that households have needs for financial decision-making, including spending and buying items as needed, earning extra income, increasing investment financial capacity, planning spending, and earning income and expense control. Regarding financial sense, confidence that there is money available in case of an emergency is important, as well as an absence of concern over income and expenses, and satisfaction with household savings. Our guidelines for promoting household financial wellbeing included financial planning for reserves, fund management and investments to generate returns, spending according to the philosophy of sufficiency economy, and organizing activities and saving projects.

Keywords: Financial wellbeing, Financial decisions, Financial capacity, Financial sense.

INTRODUCTION

Financial wellbeing is an important issue linked to several sustainable development goals (Fu, 2019. These include goal number #1 (eliminate all forms of poverty in all areas), #8 (promote sustained, inclusive and sustainable economic growth), #10 (reduce inequality within and between countries) and #16 (promote peaceful and inclusive societies for sustainable development). Financial wellbeing refers to an individual’s or family’s mental health and wellbeing regarding financial matters, their control of money on a daily and monthly basis. The ability to absorb financial shocks, the feeling of being on track to achieve financial goals, being financially independent enough to make life-satisfying choices (Consumer Financial Protection Bureau, 2015), and meeting one’s financial needs and responsibilities of current and future lifestyles (Brüggen et al., 2017; Kempson et al., 2017) are examples of financial wellbeing.

Handayan et al. (2016) notes that indebtedness leads to lower financial wellbeing and is a cause of financial stress (Joo, 1998, as cited in Ferrer, 2017). Having financial distress has a negative effect on physical and mental health and results in decreased confidence and productivity (Godfrey, 2006, as cited in Ferrer, 2017; Van Praag et al., 2003, as cited in Ferrer, 2017). Households with low financial wellbeing are more likely to experience financial-related psychological distress (Lai 2011; Park & Kim, 2018; Thorne, 2010; Sweet et al., 2013, as cited in Friedline et al., 2020). Cost of living crises such as high inflation impact households around the world, affecting people’s financial wellbeing. Managing financial wellbeing requires rapid action to prevent problems such as increased household debt, financial distress, and poverty (CIPD, 2017).

The World Bank and International Monetary Fund believed there was a very high chance that the global economy would face a recession in 2023. This would inevitably affect the Thailand economy as well (Thongsaichon, 2023). This economic climate inevitably affects the financial wellbeing of Thailand households, especially in urban and semi-rural communities where the main household income is from employment and there is economic inequality (Boontrai, 2015).

Nonthaburi province is one of the five provinces with the highest average household debt in Thailand. The average household debt in 2021 was 330,809 Thailand baht (National Statistical Office, Nonthaburi Province, 2021). Bang Kruai district is a semi-rural urban community in Nonthaburi with economic inequality: 15 percent of households had incomes less than 38,000 baht per year in 2018 (Nonthaburi Office, 2018) with an average expenditure of 77,340 baht per person per year, and an average debt of 31,209 baht per month (Nonthaburi Office, 2019). Households have many non-essential living expenses. The heads of households spend money inefficiently, such as choosing to buy alcoholic beverages for consumption, cigarettes and entertainment media, etc., as well as buying legal and illegal government lottery tickets to gamble, with average expenditures totaling 11,969 baht per month (Nonthaburi Office, 2020). For households in Bang Kruai, there is a risk of increased household debt and lower financial wellbeing.

Financial wellbeing is a result of a combination of the impacts of the socioeconomic environment, one’s financial behavior, financial literacy, personal characteristics, and financial attitude. Therefore these factors must be taken into account in order to promote the financial wellbeing of households. So must the ideas of Keynes (1936) as applied to the household ( Chanwittayapong, 2020), and the philosophy of Thailand’s sufficiency economy, with its focus on self- or household development taking into account moderation, reasonableness, and building restraint, as well as using knowledge, prudence, and morality (Chaipattana Foundation, 2016). This must be applied at the individual and household levels to help people cope with financial challenges during economic crises and to solve or alleviate the current high household debt problem. It is necessary to align sufficiency economy guidelines with the context and needs of households.

RESEARCH OBJECTIVES

This research aims to present guidelines for promoting the financial wellbeing of households in Bang Kruai district. It is based on the needs of households to promote financial wellbeing and finds determinants of financial wellbeing through integrating financial theories such as the philosophy of the sufficiency economy. The prescriptions it provides can be applied by the local community to develop the financial wellbeing of households for maximum benefit. With that said, the two research objectives are: 1) To assess the needs for promoting financial wellbeing of households in Bang Kruai district, Nonthaburi, and 2) To create guidelines for promoting household financial wellbeing that are suitable for communities in Bang Kruai district.

CONCEPTUAL FRAMEWORK

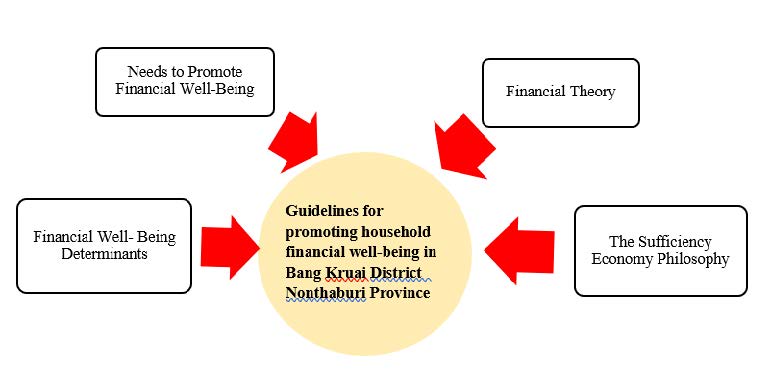

To develop our guidelines for promoting the financial wellbeing of households in Bang Kruai, we used our results from assessing the needs to promote the financial wellbeing, then analyzed and synthesized these together with related concepts such as financial theory, the philosophy of sufficiency economy, and the determinants of financial wellbeing, as shown in figure 1.

Figure 1

Conceptual framework.

LITERATURE REVIEW

We examined and synthesized documents related to financial wellbeing including those by Neill et al. (2006) and Taft et al. (2013) to explain that financial wellbeing is a result of subjective perceptions and objective indicators of an individual’s financial status. Kempson et al. (2017) define financial wellbeing as the extent to which an individual is able to fulfill their obligations. Convenience and financial flexibility must be maintained in the future. This is consistent with Muir et al. (2017), whereby financial wellbeing is the ability of individuals to earn more than their expenses and have some money left over; they are able to control their own finances and feel financially secure now and in the future. Finally, Prendergast (2018) defines financial wellbeing as a measure of subjective feelings and preferences about financial situations and objective measures of financial behavior. It can be concluded that the financial wellbeing of households consists of: financial decisions, financial capacities, and financial sense.

DETERMINANTS OF FINANCIAL WELLBEING

Noone et al. (2016), the Consumer Financial Protection Bureau (2017), Kempson et al. (2017), Bowman et al. (2017), Muir et al. (2017) and Prendergast (2018) all discuss the determinants of financial wellbeing. Based on this review, there are three internal determining factors: 1) Financial behavior, which means that a person tends to think, feel, and act on financial activities; 2) Financial literacy, which refers to what a person perceives and can understand in regard to financial matters, similar to financial capacity, which refers to what a person knows how to perform important financial tasks; and 3) Financial attitude, which is whether one enjoys spending more than saving. Then there are personal characteristics, which refer to individual characteristics in accessing funding sources. Financial conditions can be difficult, thus limiting the financial welling of some groups of people unable to access financial resources.

A theory of Keynes (1936) describes the money management principle of individuals or households by categorizing holding money three ways: 1) There is a need to hold money for daily living means and purchasing goods and services; 2) The need to hold money as a reserve fund in the event of an emergency means that individuals and households can build resilience by holding a certain amount of cash for unexpected expenses; 3) The need to hold money for speculation means that individuals and households want to keep money in order to generate returns from saving money by investing for profit (Chanwittayapong, 2020)

The Sufficiency Economy Philosophy is a form of economic management that is suitable for individuals or households in line with the changing environment with several principles. These include reasonableness, or decisions concerning the level of sufficiency, which must be made rationally with consideration of the factors involved and careful anticipation of the outcomes that may be expected from such action. Then there is moderation, or sufficiency at a standard that is not too little or too much, at the expense of oneself or others, for example, producing and consuming at a moderate level. Then there is the principle of self-immunity: preparing yourself to be ready for impacts and changes. This means taking into account the possibility of various situations that are expected to occur in the future. The prudence to take knowledge on possibilities into account is linked to supportive planning and caution in practice, and moral conditions that must be strengthened, and awareness of honesty, patience, perseverance and wisdom in life (Chaipattana Foundation, 2016)

To promote financial wellbeing we must take into considering what the difference between the actual situation and the expected situation looks like (Wongwanich, 2019). Financial needs, in order to promote financial wellbeing, is determined by differences in the actual situation. Realizing what the situation should be consists of three steps: identifying needs and prioritizing, analyzing the reasons for the need, and identifying options to meet the needs of all three aspects of financial wellbeing: financial decision-making, financial capacity, and financial sense.

METHODOLOGY

This article uses quantitative methods, divided into two steps. The first step is assessing the needs. It is divided into sub-steps: (1) Identifying needs and prioritizing them, (2) Analyzing causes according to needs, and (3) Identifying options to meet needs and promote the financial wellbeing of households of the population. There are a total of 69,901 household representatives in Bang Kruai district (Bureau of Registration Administration, 2020). A multi-stage sampling method was used to randomly select two sub-districts, Bang Khanun and Plai Bang. Then random villages were selected in each sub-district: Moo 5 for Bang Khanun and Moo 4 for Plai Bang. 200 households in each village were randomly identified, for a total of 400. The samples were calculated according to Yamane’s formula (Yamtim, 2015) with a confidence level of 95 percent for sampling and a tolerance of no more than 5 percent.

This research project provided questionnaires to household representatives from these 400 households. Those who responded to the questionnaire were mostly female, 55 percent, and 28 percent were aged 20-30 years old. Most were employees of private companies (42 percent) and graduated with a bachelor’s degree (54 percent). Most households had three household members (32 percent). A total of 64 percent of respondents had a monthly income in the range of 10,001-70,000 baht, having expenses of between 10,001-70,000 baht (72.5 percent), and having debt obligations of 10,001-70,000 baht (64 percent). Most did not have savings (57 percent). Most of the savers deposited money into banks (87 percent) and saved 1,001-3,000 baht per month (79 percent).

The second step was to create guidelines for promoting household financial wellbeing relying on six expert informants. These included three teachers with academic positions in finance, accounting or economics, two community leaders, and a local government official who has experience in solving community problems.

RESEARCH TOOLS

The questionnaire research tool used was the pair response type. The estimation scale was rated at five levels, from least to most, and divided into three aspects: financial decision-making, financial capacity and financial sense. The content validity was examined by the index of congruence between the question and the variable definition, between 0.67-1.00, and the reliability was analyzed by Cronbach's alpha coefficient. The questionnaire had a reliability of 0.95. There was also the suitability assessment form and the usefulness of household financial wellbeing promotion guidelines. Its content validity was verified through the approval of an adviser.

STATISTICS USED TO ANALYZE DATA

The questionnaire data was analyzed through frequency, percentage, mean, standard deviation, median, mode, and quartile, the Modified Priority Needs Index (PNI Modified) (Vongvanich, 2019). Necessary needs were determined from each item’s PNI Modified value that was higher or equal to the mean value of each PNI Modified value.

RESULTS

PART 1: NEEDS TO PROMOTE THE FINANCIAL WELLBEING OF HOUSEHOLDS

The sequence of needs assessment needed to promote the financial wellbeing of individual households is shown in table 1. There were current conditions and expected conditions at a high level (X = 3.78, SD = 1.34 and X = 3.93, SD = 1.01 respectively), financial sense with the current condition at a medium level (X = 3.27, SD = 1.39, X = 3.36, SD = 1.32, respectively), and the expected condition was at a high level (X = 3.68, SD = 1.24, X = 3.68, SD = 1.18, respectively). Households have the following needs to promote financial wellbeing.

Table 1

The sequence of needs assessment needed to promote the financial wellbeing of individual households.

|

No. |

Item List |

Current Condition |

Expected Condition |

PNI Modifier |

||

|

X |

SD |

X |

SD |

|||

|

Financial Decision-making |

3.78 |

1.34 |

3.93 |

1.01 |

0.04 |

|

|

1 |

Spending as Necessary to Meet the Family’s Income |

3.66 |

1.25 |

4.04 |

0.91 |

0.10 |

|

2 |

Purchasing as Needed, Even if Earning Enough |

3.70 |

1.32 |

4.04 |

0.91 |

0.08 |

|

3 |

Earning Extra Income to Prevent Unexpected Financial Events |

3.74 |

1.20 |

3.94 |

0.96 |

0.05 |

|

4 |

Investing in Securities Such as Stocks, Bonds, and Real Estate as a Model to Diversify Risks to Create Returns in the Future |

3.84 |

1.15 |

4.02 |

1.08 |

0.04 |

|

5 |

Choosing to Pay Only Some of the Debt as Early as Possible to Reduce the Obligation to Pay More than Before |

3.81 |

1.12 |

3.90 |

1.00 |

0.02 |

|

6 |

Choose to Insure Life, to Save and Prevent the Risk of Losing Income in the Future |

3.76 |

1.22 |

3.83 |

1.17 |

0.01 |

|

7 |

Choose to Save with a Bank with an Amount that Does Not Affect Household Expenses |

3.83 |

1.21 |

3.90 |

1.09 |

0.01 |

|

8 |

Choose to Reduce Unnecessary Expenses when Faced with Expenses Higher than Income |

3.91 |

2.38 |

3.96 |

0.96 |

0.01 |

|

9 |

Having insufficient income to pay off all debts, households choose to pay off high-interest debt first, respectively |

3.80 |

1.20 |

3.84 |

1.00 |

0.01 |

|

Financial capacity |

3.27 |

1.39 |

3.68 |

1.24 |

0.12 |

|

|

1 |

Planning for Proper Income Allocation for Regular Household Expenses |

3.05 |

1.35 |

3.78 |

1.20 |

0.23 |

|

2 |

Planning for Earning Enough to Meet Expenses and Remaining Enough to Save Money |

3.14 |

1.33 |

3.79 |

1.21 |

0.20 |

|

3 |

Controlling Unnecessary Expenses in Order to Have Sufficient Savings After Retirement |

3.21 |

1.42 |

3.81 |

1.26 |

0.18 |

|

4 |

Expense Recording and Proper Spending Planning |

3.21 |

1.57 |

3.66 |

1.24 |

0.14 |

|

5 |

Calculating and Comparing Returns From Savings |

3.14 |

1.31 |

3.56 |

1.31 |

0.13 |

|

6 |

Taking Care not to Incur More Debt than Necessary |

3.18 |

1.47 |

3.53 |

1.28 |

0.11 |

|

7 |

Planning Expenditures for Investing in Income-Generating Assets in the Future |

3.37 |

1.51 |

3.70 |

1.12 |

0.09 |

|

8 |

Preparing to Plan Income after Retirement to be Sufficient to Meet Needs |

3.63 |

1.23 |

3.72 |

1.25 |

0.02 |

|

9 |

Systematic Planning for Savings or Investments in Line with Current Income |

3.57 |

1.31 |

3.62 |

1.24 |

0.01 |

|

Financial sense |

3.36 |

1.32 |

3.68 |

1.18 |

0.09 |

|

|

1 |

Ensuring that the Household has Enough Money to Pay in the Event of an Emergency |

3.24 |

1.29 |

3.76 |

1.21 |

0.16 |

|

2 |

The Worry that Household Income Will not be Enough for the Whole Month |

3.29 |

1.42 |

3.75 |

1.19 |

0.13 |

|

3 |

A Sense of Satisfaction With the Amount of Household Savings Available |

3.27 |

1.33 |

3.67 |

1.19 |

0.12 |

|

4 |

Insensitivity to Household Expenses |

3.34 |

1.37 |

3.64 |

1.09 |

0.11 |

|

5 |

Confidence in Having Enough Money to Meet Household Expenses |

3.44 |

1.29 |

3.76 |

1.21 |

0.09 |

|

6 |

Satisfaction with Current Household Income |

3.36 |

1.28 |

3.64 |

1.09 |

0.08 |

|

7 |

Not Worrying About Being Unable to Save Money According to Goals |

3.50 |

1.18 |

3.68 |

1.13 |

0.05 |

|

8 |

Ensuring Households Achieve Targeted Return on Investment |

3.25 |

1.45 |

3.75 |

1.29 |

0.04 |

|

9 |

Lack of Concern Over the Amount of Household Debt |

3.63 |

1.20 |

3.78 |

1.14 |

0.04 |

|

Total Average |

3.36 |

1.32 |

3.68 |

1.18 |

0.09 |

|

Note: *** Consider taking the PNI Modified Index, the order of need in each aspect, and then find the mean value of the PNI Modified value. If the order of the PNI Modified value is higher than the mean it will need to be developed urgently.

There were four financial decisions: 1) Spending as much as necessary to meet family income; 2) Purchasing necessary products even though there is enough income; 3) Earning extra income to prevent accidents; and 4) Investing in securities such as stocks, bonds, real estate as a model to diversify risks to create future returns (PNI Modified equal to 0.10, 0.08, 0.05 and 0.04 respectively).

In terms of financial capacity there were five aspects: 1) Planning for appropriate income allocation for regular household expenses; 2) Planning for earning sufficient income for expenditures and with remains sufficient for saving; 3) Controlling unnecessary expenses in order to have sufficient savings after retirement; 4) Expense recording and appropriate spending planning; and 5) Calculation and comparison of returns from savings (PNI Modified equals 0.23, 0.20, 0.18, 0.14, and 0.13 respectively).

In terms of financial sense, there were four factors: 1) The confidence that the household had enough money in the event of an emergency; 2) The fear that household income would not be enough for the whole month; 3) Satisfaction with the amount of household savings available; and 4) No concern about household expenses (PNI Modified was 0.16, 0.13, 0.12 and 0.11, respectively).

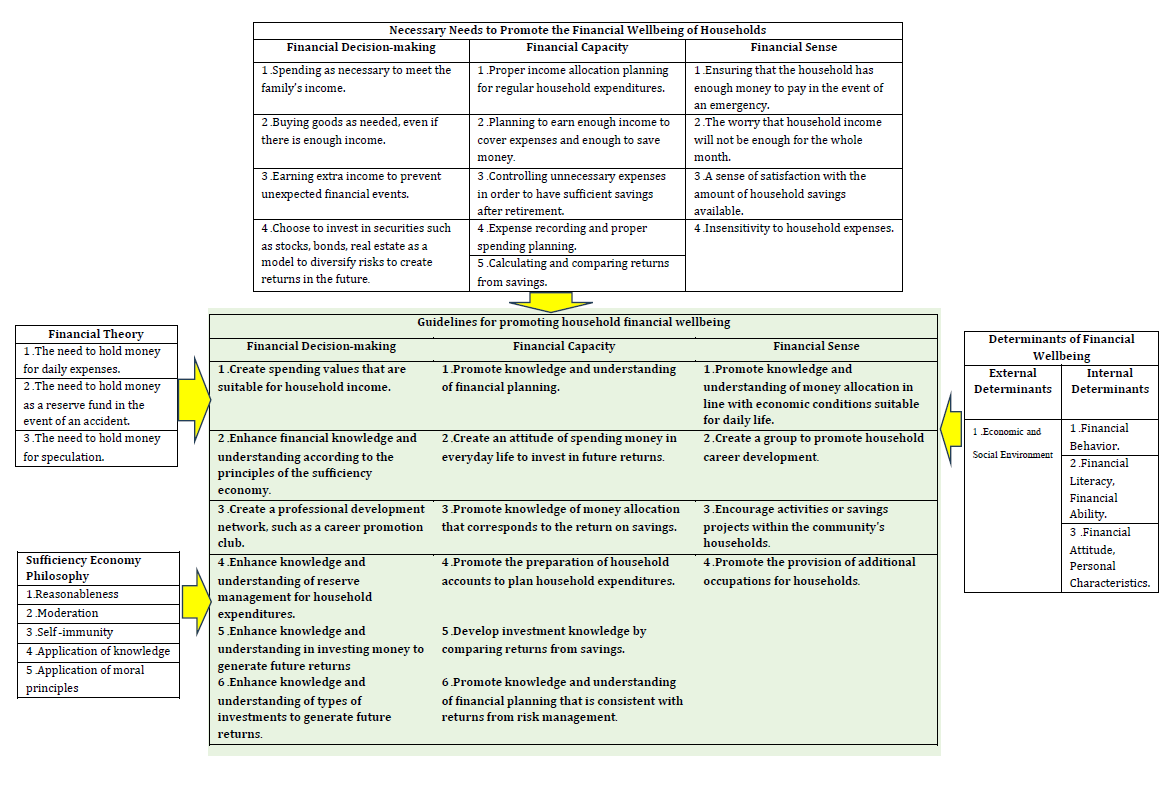

PART 2: GUIDELINES FOR PROMOTING THE FINANCIAL WELLBEING OF HOUSEHOLDS

The need to promote the financial wellbeing of households and determinants of financial wellbeing were analyzed and synthesized. The guidelines for promoting the financial wellbeing of households are shown in figure 2 and the details are as follows.

There were six approaches to household financial decision-making: 1) Creating spending values that are appropriate to household income; 2) Promoting financial literacy according to the sufficiency economy principle; 3) Creating a professional development network such as clubs for career promotion; 4) Enhance knowledge and understanding of reserve management for household spending; 5) Enhance knowledge and understanding of investment expenditures to generate future returns; and 6) Enhance knowledge and understanding of types of investments to generate returns in the future.

There were six approaches to a household’s financial capacity: 1) Promote knowledge and understanding of financial planning; 2) Create an attitude of spending money in daily life to invest in future returns; 3) Promote knowledge of appropriate money allocation; 4) Promote the preparation of a household account to plan household spending; 5) Develop investment knowledge by comparing the return of savings; and 6) Promote planning knowledge and understanding financially consistent with the return on risk management.

There were four approaches to household financial sense: 1) Promoting knowledge and understanding of spending money in daily life in line with economic conditions; 2) Creating a group to promote household career development; 3) Promoting activities or savings projects within the household; and 4) Promoting the provision of additional occupations for the household.

PART 3: GUIDELINES FOR PROMOTING HOUSEHOLD FINANCIAL WELLBEING

We developed 16 guidelines for promoting the financial wellbeing of households. There are six approaches to financial decision-making, six approaches to financial capacity, and four approaches to financial sense. The suitability of our guidelines for promoting household financial wellbeing received affirmative consensus from our group of experts. The median value was 4-5, the absolute value of the median difference and the mode were 0.00-1.00, and the interquartile difference range was 0.00-1.50 as shown in table 2. The details are as follows.

For financial decision-making, the experts agree that promotion guidelines are appropriate, possible and most beneficial. There are two approaches, namely 1) Creating spending values that are suitable for household income, and 2) Promoting financial knowledge and understanding according to the sufficiency economy principle. (The median value was 5). Expert groups agree that it is very possible (median value of 4), appropriate and most useful (median was 5 and 4.50, respectively). The remaining approaches were enhancing knowledge and understanding reserve management for household spending in the future, and enhancing knowledge and understanding types of investments to generate returns in the future. Experts agree that it is appropriate with a high possibility that is very helpful (median = 4.00).

For financial capacity, the experts agree that the promotion approach is most appropriate and beneficial. But there are a lot of possibilities. There are two approaches: 1) Promote knowledge and understanding of financial planning (medians 5, 5 and 4 respectively); and 2) Promoting the preparation of household accounts to plan household expenditures (medians 4.50, 5 and 4, respectively) and the promotion guidelines were appropriate. There are three approaches that are very useful: 1) Promote knowledge of money allocation in line with returns with savings; 2) Develop knowledge and understanding of investments by comparing returns with savings; and 3) Promote knowledge and understanding of investments by comparing returns with savings. Know and understand financial planning that is consistent with the return on risk management (median value 4.00) and the promotion approach was found to be appropriate and very feasible. But the guideline with the most benefit is to create an attitude of spending money in everyday life to invest for future returns (medians 4, 4 and 5, respectively).

For financial sense, the expert group agreed that two approaches are most suitable, feasible and beneficial, namely 1) Creating a group to promote household career development and 2) Promoting additional occupations for households. But there are many possibilities. Two more are 1) Promote knowledge and understanding of money allocation in accordance with economic conditions suitable for daily life and 2) Promote activities or projects to save within households (medians 4.5, 4.5 and 4 respectively).

Figure 2

Guidelines for promoting household financial wellbeing.

Table 2

Guidelines for promoting financial wellbeing of households and their suitability, possibility and benefit.

|

Guidelines for promoting household financial wellbeing |

Suitability |

Possibility |

Benefit |

||||||

|

Mdn |

|Mo-Mdn| |

Q3 – Q1 |

Mdn |

|Mo-Mdn| |

Q3 – Q1 |

Mdn |

|Mo-Mdn| |

Q3 – Q1 |

|

|

Financial Decision-making |

|

|

|

|

|

|

|

|

|

|

1. Create spending values that are suitable for household income |

5.00 |

1.00 |

1.00 |

5.00 |

0.00 |

1.50 |

5.00 |

0.00 |

1.00 |

|

2.. Enhance financial knowledge and understanding according to the principles of sufficiency economy. |

5.00 |

0.00 |

0.00 |

5.00 |

0.50 |

1.25 |

5.00 |

0.00 |

0.25 |

|

3. Create a professional development network, such as a career promotion club |

5.00 |

0.00 |

0.00 |

4.00 |

0.00 |

0.00 |

4.50 |

0.50 |

1.00 |

|

4. Enhance knowledge and understanding of reserve management for household expenditures |

4.00 |

0.00 |

1.00 |

4.00 |

0.50 |

1.00 |

4.00 |

0.50 |

0.25 |

|

5. Enhance knowledge and understanding in investing money to generate future returns |

4.00 |

0.00 |

1.00 |

4.00 |

0.00 |

1.25 |

4.00 |

0.00 |

0.25 |

|

6. Enhance knowledge and understanding of types of investments to generate future returns |

4.00 |

0.00 |

0.50 |

4.00 |

0.00 |

1.50 |

4.00 |

0.00 |

0.00 |

|

Financial Capacity |

|

|

|

|

|

|

|

|

|

|

1 Promote knowledge and understanding of financial planning |

5.00 |

0.00 |

0.00 |

4.00 |

0.00 |

1.20 |

5.00 |

0.00 |

0.00 |

|

2 Create an attitude of spending money in everyday life to invest in future returns. |

4.00 |

0.00 |

1.00 |

4.00 |

0.00 |

1.25 |

5.00 |

0.00 |

1.00 |

|

3 Promote knowledge of money allocation that corresponds to the return on savings |

4.00 |

0.00 |

0.20 |

4.00 |

0.00 |

1.00 |

4.00 |

0.00 |

0.30 |

|

4. Promote the preparation of household accounts to plan household expenditures |

4.50 |

0.50 |

1.00 |

4.00 |

0.00 |

1.25 |

5.00 |

0.00 |

0.25 |

|

5 Develop investment knowledge by comparing returns from savings |

4.00 |

0.00 |

0.00 |

4.00 |

0.00 |

1.00 |

4.00 |

0.00 |

0.00 |

|

6 Promote knowledge and understanding of financial planning that is consistent with returns from risk management. |

4.00 |

0.00 |

1.00 |

4.00 |

0.00 |

0.50 |

4.00 |

0.00 |

0.00 |

|

Financial Sense |

|

|

|

|

|

|

|

|

|

|

1. promote knowledge and understanding of money allocation in line with economic conditions suitable for daily life |

5.00 |

0.00 |

1.00 |

4.00 |

0.00 |

0.25 |

5.00 |

0.00 |

1.00 |

|

2 Create a group to promote household career development. |

4.50 |

0.50 |

1.00 |

4.50 |

0.50 |

1.00 |

4.50 |

0.50 |

1.00 |

|

3 Encourage activities or savings projects within the community's households |

4.50 |

0.00 |

1.00 |

4.00 |

0.00 |

1.00 |

4.50 |

0.50 |

1.00 |

|

4 Promote the provision of additional occupations for households. |

4.50 |

0.00 |

1.00 |

4.50 |

0.50 |

1.00 |

4.50 |

0.50 |

1.00 |

DISCUSSION

Our research found that there are four essential needs for promoting financial decision-making in households: 1) Spending sparingly to meet family income; 2) Purchasing essential goods despite having sufficient income; 3) Earning extra income to mitigate unexpected situations; and 4) Choose to invest in securities such as stocks, bonds, real estate as a model to diversify risks and create returns in the future. Financial decision-making is the evaluation of appropriate financial options that will lead to good financial wellbeing by spending money as needed rationally. (Payutto, 1999) talks about consumption that is not intoxicating. In addition to spending money, households also need to earn extra income to mitigate the effects of unexpected financial events, and choose to invest in securities such as stocks, bonds, and real estate to diversify risks and generate returns in the future. This is consistent with the financial theory of Keynes (1936), which mentions the need to hold money as a reserve fund in the event of an emergency. Households build their own financial immunity by holding on to cash for emergency needs, saving in order to generate returns and invest for profit (Chanwittayapong, 2020).

In terms of financial capacity, households had five essential needs: 1) Planning for proper income allocation for regular household expenditures; 2) Planning for earning enough income for existing expenses and having enough left over for savings; 3) Controlling unnecessary expenditures in order to have sufficient savings after retirement; 4) Expense recording and proper spending planning; and 5) Calculation and comparison of returns from savings. Financial ability is the planning, control, and management that is appropriate to the situation and environment that allows it to be effective in achieving the financial goals of individuals and households. Proper allocation of income and expenses for household spending after retirement so as to have enough left to save, and comparative calculations of returns from savings, are in line with the concept of the “financial wellbeing tree” of Muir et al. (2017) which found that there are many internal and external factors determining financial wellbeing.

In terms of financial sentiment, households had four essential needs. These included confidence that the household had enough money to pay in the event of an emergency satisfaction with the amount of household savings available, and a lack of concern about household expenses. To be financially healthy, households must feel confident that they have enough money for emergencies and do not worry about household income. This is in line with Keynes’ financial theory (1936) that describes the transaction demand for money by purchasing goods and services and the need to hold money as a reserve fund in the event of an emergency (precautionary demand for money). Households will build their own financial immunity by holding on to a certain amount of cash for urgent needs and emergencies. This is in line with the philosophy of the sufficiency economy, with its principle of rationality, meaning that decisions must be rational. Decisions must consider all factors involved as well as take into account the results that are expected to occur from actions carefully. The principle of moderation means that it is not too little and not too much. Planning for household expenses is important. The principle of building immunity means preparing yourself to be ready for the impacts and changes in various aspects that will occur and taking into account the possibility of various situations occurring in the future (Chaipattana Foundation, 2016).

Six financial decisions factor into creating guidelines for promoting household financial wellbeing in Bang Kruai. These are: 1) Create spending values that are suitable for household income; 2) Promote financial knowledge and understanding according to the sufficiency economy principle; 3) Create a professional development network such as a career promotion club; 4) Enhance knowledge and understanding of reserve management for household expenditures; 5) Enhance knowledge and understanding of investment expenditures to generate future returns; and 6) Enhance knowledge and understanding of types of investment to generate future returns. It can be seen that this approach to promoting financial wellbeing is consistent with the factors determining economic and social conditions, financial behaviors, financial literacy and competence. Most of the research samples have income not enough for expenses. This reflects the sample group’s inappropriate household spending behavior, in line with research on the concept of financial wellbeing correction (Brüggen et al., 2017), that presents good financial wellbeing and promotes happiness with interventions to change financial behavior. Financial literacy results in wealth for persons or households and leads to an increase in economic growth and further expanded knowledge, and improved quality of life and financial wellbeing.

This research found that there are six approaches for promoting financial capacity: 1) Promote knowledge and understanding of financial planning; 2) Create an attitude of spending money in everyday life to invest in future returns; 3) Promote knowledge of money allocation that is consistent with returns from saving; 4) Promote the preparation of household accounts to plan for household spending; 5) Develop investment knowledge by comparing returns from saving; and 6) Promote knowledge and understanding of financial planning. Regarding returns on risk management, it can be seen that the approach to promoting financial wellbeing is in line with the determining factor of financial knowledge and competence. Most people interviewed do not have savings, 57 percent, reflecting the lack of development of financial knowledge and understanding, consistent with Shim et al. (2009) and their findings on how to make individuals financially literate. Financial literacy can help achieve financial success.

There are four approaches to promoting financial sentiment: 1) Promoting knowledge and understanding of money allocation in line with economic conditions suitable for daily life; 2) Creating a group to promote household career development; 3) Promoting activities or projects for savings within community households, and 4) Promoting the provision of additional occupations for households. It can be seen that approaches to promoting financial wellbeing are consistent with the factors determining economic and social conditions. Financial literacy, competence and personal characteristics, such as attitude, are complex, with research results showing that most respondents have debt burdens and no savings. This reflects the lack of financial wellbeing management in the sample group. An analysis of the financial wellbeing of teachers in the Philippines (Ferrer, 2017) suggests solving the debt situation by allowing households to earn more to support the family also contributes to the reduction of teachers’ financial difficulties. Technical skills training or entrepreneurship education to increase employment opportunities for household income are in line with the philosophy of the sufficiency economy (Chaipattana Foundation, 2016), which uses principles of economic management suitable for individuals or households in line with changes in the environment.

CONCLUSION

The guidelines here developed for appropriately promoting financial wellbeing of households in Bang Kruai district, Nonthaburi province, have ended up totaling 13 topics. These consist of financial decision-making, with four topics, financial capability, with five topics, and financial sense, with four topics. By assessing the need to promote the financial wellbeing of households in the district, guidelines for were created. These totaled 16 approaches for households, divided into six approaches to promoting financial wellbeing in decision-making, six approaches to financial wellbeing in terms of financial capacity, and four approaches to financial wellbeing in terms of financial sense. All 16 approaches consist of 1) Enhancing knowledge and understanding about financial planning, such as reserve fund management, investing and spending according to the philosophy of sufficiency economy; 2) Create appropriate attitudes toward spending; and 3) Create a network to promote careers and organize activities or savings projects.

ETHICS APPROVAL

This research was approved by the Kasetsart University Research Ethics Committee, COA No. COA65/048.

SUGGESTIONS FOR FURTHER RESEARCH

1. The Community Development Division, of the Tambon Administrative Organization in Bang Kruai district, Nonthaburi province, should use the guidelines for promoting financial wellbeing to promote the financial wellbeing of households to cover all three aspects: financial decision-making, financial capacity and financial sense. It should follow an approach that begins with something easy to initially implement and then then gradually reinforce it with the remaining approaches.

2. Although the official guidelines for promoting financial wellbeing of households obtained from this research are based on the needs of households, creating change using this approach involves many other factors. Driving this approach into practice to create change should continue, with ongoing research on best practice.

CONFLICT OF INTEREST

There is no declared conflict of interest.

REFERENCES

Bowman, D., Banks, M., Fela, G., Russell, R., & de Silva, A. (2017). Understanding financial wellbeing in times of insecurity. Brotherhood of St Laurence.

Brüggen, E. C., Hogreve, J., Holmlund, M., Kabadayi, S., & Löfgren, M. (2017). Financial well-being: A conceptualization and research agenda. Journal of Business Research, 79, 228–237. https://doi.org/10.1016/j.jbusres.2017.03.013

Boontrai, I. (2015). Quality of life of people living in rural semi-urban areas. Model Research Independent Master of Economics. Chiang Mai University.

Bureau of Registration Administration. (2020). Information from the Civil Registration Office. http://www.bora.dopa.go.th

Chaipattana Foundation. (2016). Sufficiency Economy. https://www.chaipat.or.th/publication/publish-document/sufficiency-economy.html

Consumer Financial Protection Bureau. (2017). Financial Wellbeing in America. https://files.consumerfinance.gov/f/documents/201709_cfpb_financial-well-being-in-America.pdf

Chartered Institute of Personnel and Development. (2017). Financial well-being: the employee view. Survey report January 2017 https://www.cipd.co.uk/Images/financial-well-being-employee-view-report_tcm18-17439.pdf

Chanwittayaphong, K. (2020). Monetary theory and policy. 2nd edition. Bangkok: Thammasat University Press

Ferrer, J. C. (2017). Caught in a Debt Trap? An Analysis of the Financial Well-being of Teachers in the Philippines. The Normal Lights, 11(2), Article 2. https://doi.org/10.56278/tnl.v11i2.538

Friedline, T., Chen, Z., & Morrow, S. P. (2020). Families’ Financial Stress & Well‑Being: The Importance of the Economy and Economic Environments. Springer.

Fu, T. 2019. Ability or opportunity to act: What shapes financial well-being? .World Development. 128(4):12-20

Handayan, D., Salamah, U., & Yusacc, R. N. (2016). Indebtedness and Subjective Financial Wellbeing of Households in Indonesia. Economics and Finance in Indonesia, 62(2), 78-87.

Keynes, J. M. (1936). The General Theory of Employment, Interest and Money. Harcourt Brace Jovanovich.

Kempson Elaine, Finney Andrea and Poppe Christian. (2017). Financial Well-Being A Conceptual Model and Preliminary Analysis. Final edition. CONSUMPTION RESEARCH NORWAY OSLO AND AKERSHUS UNIVERSITY COLLEGE OF APPLIED SCIENCES Stensberggt. 26.

Muir, K., Hamilton, M., Noone, J., Marjolin, A., Salignac, F., & Saunders, P. (2017). Exploring financial wellbeing in the Australian context. http://www.financialliteracy.gov.au/media/560752/research-unsw-fla-exploringfinancialwellbeingintheaustraliancontextreport-201709.pdf,

National Statistical Office, Nonthaburi Province, (2021). Survey of household economic and social conditions 2021. http://www.nso.go.th/sites/2014/Pages/home.aspx

Nonthaburi Office of Human Development and Security. (2021). Nonthaburi Province Quality of Life Report 2020. http://nonthaburi.m-society.go.th/

Nonthaburi Office of Human Development and Security. (2019). Nonthaburi Province Quality of Life Report 2019. http://nonthaburi.m-society.go.th/

Nonthaburi Office of Human Development and Security. (2018). Nonthaburi Province Quality of Life Report 2018. http://nonthaburi.m-society.go.th/

Noone, J., Muir, K., Salignac, F., Reeve, R., Marjolin, A., Hamilton, M., Saunders, P., Wong, M., & Bullen, J. (2016, December 5). An Australian framework for financial wellbeing [Paper presentation]. All being well? Financial wellbeing, inclusion and risk seminar. RMIT University. https://library.bsl.org.au/jspui/bitstream/1/9374/1/Russell_etal_All_being_well_seminar_summary_2017.pdf

Neill, B. O., Prawitz A. D., Sorhaindo, B., Kim, J.A, & Garman, E. T. 2006. Changes in Health, Negative Financial Events, and Financial Distress/Financial Well-Being for Debt Management Program Clients. Article in Journal of Financial Counseling and Planning • January 2006

Payutto, P. A. (1999). Decade of Thammathat, Phra Dhammapitaka. Thammasapa.

Prendergast, S. (2018). Financial Wellbeing: A Survey of Adults in New Zealand. ANZ Banking Group Limited.

Shim, S., Xiao, J. J., Barber, B. L., & Lyons, A. C. (2009). Pathways to life success: A conceptual model of financial well-being for young adults. Journal of Applied Developmental Psychology, 30(6), 708–723. https://doi.org/10.1016/j.appdev.2009.02.003

Taft, M. K., Hosein Z .Z., Mehrizi S M T. & Roshan, A. (2013). The Relation between Financial Literacy, Financial Wellbeing and Financial Concerns. International Journal of Business and Management; 8(11): 63-75

Thongsaichon, N. (2023). Catch the pulse of the world economy: Look at the Thai economy in 2023. Department of Develop Investor Knowledge, The Stock Exchange of Thailand. https://www.setinvestnow.com/

Vongvanich, S. (2019). Needs Assessment Research is Necessary. Chulalongkorn University.

Yamtim, V. (2015). Research methods in agriculture and environmental studies. Department of Human Resource and Community Development, Education and Development Sciences, Kasetsart University.