ABSTRACT

This study develops a marketing information system algorithm for determining whether and to what degree customers of mobile phone businesses prefer their own brands after experiencing problems with their current product, or in customer service or repair services during or at the end of an average use period for their product. With a process map and system algorithm, a data analytics model required for creating a satisfied and loyal customer group is described based on analysis results obtained by tracking/analyzing customer experiences in different processes. The article‘s findings can help to optimize product, sales, and service development activities focused on business profitability by highlighting data-driven customer experience tracking systems for business.

Keywords Customer experience, CRM, Current customer, System algorithm, Conceptual modeling.

INTRODUCTION

“The cost of retaining current customers is always lower than the cost of acquiring new customers.” This is a general marketing motto, so: How do we manage this in the mobile phone industry? How do we track the purchasing behavior of current customers? How do we ensure to “regain current customers?”[1] What is the connection between new campaign offers for current customers (customization) and Customer Experience (CE) of the product, service or company? How can customer relationship development be achieved beyond calculating customer lifetime value in the mobile phone industry?

[1] Regaining current customers: This can be described as all marketing activities to ensure that customers who tend to be not satisfied with their product, price, service or repair services experience prefer the products of the current brand again in the future.

While it is widely agreed in business and marketing that retaining current customers is lower than the cost of acquiring new customers, this can lead businesses in their customer relationship processes to shy away from being future-oriented and only make financial calculations for current customers. In other words, it is important to calculate the possible lifetime revenue of current customers to a business to determine the financial values of the customer cost (the average marketing budget spent to acquire a customer) during a certain period or campaign, but it may only provide information about the present, rather than the future, if using a static approach. Thanks to current technological developments and customers ‘ intense use of technology in their daily lives, it is now possible to obtain much more information about customers than we used to in the past.

Generally, businesses can develop approaches such as differential pricing in order to control the periodic demand levels for their products or services, to respond to different payment requests of different income groups, and to use up their stocks in the right way. Price differentiation is one of the practices that directly contributes to maximizing profits and revenues. In addition, practices as price differentiation are frequently used to attract new customer groups. However, these marketing efforts, which are developed to acquire new customers and new revenues, can still create some perceptual disadvantages for current customers despite their significant advantages for businesses. These practices may also cause some customer groups to become alienated from the business/brand (Kimes, 1994; Jin et al., 2014; Sığırcı & Gegez, 2019). In this context, monitoring current customers according to their experiences, identifying new customer groups by evaluating their contribution to profitability and revenue for business and their repeat purchasing behavior can provide significant advantages for Customer Relationship Management (CRM).

To retain customers and reduce churn, companies focus on satisfying customers. Customer retention is the ultimate goal of CRM. Customer churn happens when customers stop transacting with a company. Customer churn is an undesirable challenge for most industries. Therefore, it is important to create an accurate churn forecasting model and data analysis system that can be useful in providing customer retention strategies (Li et al., 2021).

Apple and Samsung, traditional and popular brands, dominate the mobile phone market. However, in recent years, many other brands originating from far east Asian countries have gained a foothold. In fact, according to the second quarter figures for 2021 announced by the market research organization Canalys, Chinese brand Xiaomi has outpaced USA brand Apple. Having grown by 83 percent in the last year, Xiaomi surpassed Apple to become second in the market for the first time in its history. Xiaomi increased its share in Europe, China and many other Asian markets, gradually taking over Huawei’s position there. These market share calculations are made on the basis of units or indexed income.

But what is important for a brand is not a one-time supply of a product. It is the creation of a loyal and satisfied customer base for a brand. In order to achieve this, smartphone brands also need to develop data-driven optimization models on customer’s experience and satisfaction. This study aims to monitor the experiences of smartphone customers, to influence the design of experience-oriented campaign development systems and to improve sales performances, including in-store. It is necessary for smartphone market participants to follow their current customers well and to give importance to their relations with their own brands in the context of buyer-seller relations.

Beyond that, this study aims to offer a marketing information system algorithm for determining whether and to what degree customers of mobile phone businesses prefer their current brands after experiencing problems caused by product, customer service or repair services during or at the end of the average use period for their phone. Based on this model, deductions are generated for developing campaigns and marketing efforts according to customer classes for current customers that are different than new customers based on product, service, and repair service experiences. A software algorithm is presented based on the conceptual framework of customer lifetime value, calculation of customer costs, and CE regarding product, customer service, and repair services.

CONCEPTUAL FRAMEWORK

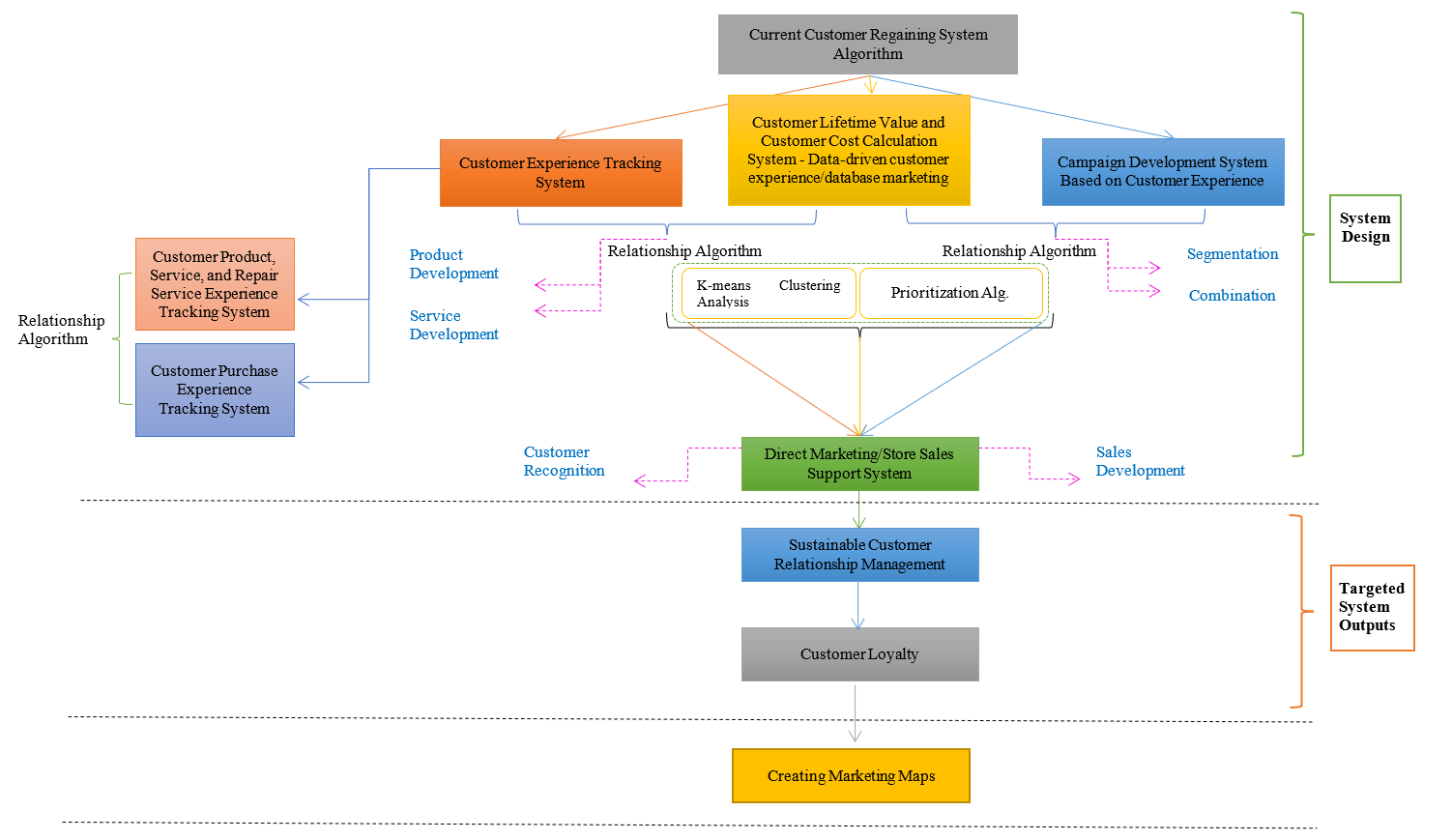

Business managers usually use customer feedback data to set measurement metrics targets and monitor performance in order to forecast future business performance (Hauser et al., 1994; Ittner & David, 1998). This helps optimize the future profitability of the business by determining customers’ “probability of repurchase”, the “probability of brand/product recommendation by word-of-mouth marketing method” and the “loyalty of customers to the brand” (Morgan et al., 2005). Businesses often use survey research methods to determine customer loyalty and future orientation, but the large amount of data generated offer significant information regarding customer loyalty and the optimization of business profitability based on such loyalty. In this study, CE and electronic data tracking system are described along with the other main concepts that build the model algorithm: Customer Lifetime Value, and Customer Cost Calculation System (database marketing), In-Store Direct Marketing (Direct Marketing), CRM and Customer Loyalty. Implementation principles for the model algorithm are also discussed.

CUSTOMER EXPERIENCE

The concept of CE is an important and complex phenomenon that needs to be measured and tested in many industry areas. CE is also very important for business’ strategic decision-making processes (Knutson et al., 2007; Komulainen & Saraniemi, 2019; Mbama et. al, 2018). It is an emotion, cognition, sensation (Moliner-Tena et al., 2019) physical and social responsibility (Verhoef et al., 2009) arising from stimuli in the interaction process between the business or the brand and the customer (Chauhan et al., 2022).

Consumers want a positive shopping experience, whether online or in-person. Consumers want to experience shopping as a complete and positive activity beyond meeting their needs. Consumers expect their shopping to be a full “experience” with an immersive, on-demand, contextual and seamless story. Melting content and commerce in the same pot, this is the epicenter of experience-oriented commerce (Saleh, 2021).

The CE is a customer journey consisting of processes such as pre-purchase, purchase and post-purchase experience, repurchase, and information transfer. These processes contain and are influenced by many nonlinear and complex elements (Alexander & Kent, 2020; Grewal & Roggeveen, 2020; Lemon & Verhoef, 2016; Puccinelli et al., 2009; Schmitt, 2003; Stein & Ramaseshan, 2016). Providing consumers with the experience they desire in all brand-customer interaction processes such as purchasing, product usage experience and after-sales services can increase customer engagement (Brodie et al., 2013; Sarmah et al., 2018, Waqas et al., 2021). Today, customers can compare prices, brands, and models online prior to purchasing. Consumers can choose from different delivery and payment options online or offline during the purchase. They experience their consumption, they use services such as repair services, they experience refund processes, and can repurchase. Moreover, they share their experiences by word of mouth (e-word of mouth, etc.) and participate in online processes (Lemon & Verhoef, 2016; Jocevski et al., 2019; Alexander & Kent, 2020). Three of these are displayed in figure 1.

Figure 1. Customer journey processes.

Today, a typical customer gains information about products through multiple channels before finally making a purchase from one of many devices and/or locations. Customers receive significant information about products and experiences before shopping thanks to their mobile devices. Brands need to understand this new customer journey to benefit from it. Companies need to monitor all the product and brand-related experiences of customers through data-oriented and online systems. Furthermore, allowing sales personnel at stores to have information about processes such as purchasing and use habits and service experiences of customers, and to manage sales process with a data-driven approach in repurchase processes, even when they do not know customers‘ names, will offer valuable resale opportunities.

Customers tend to display brand loyalty, especially in the mobile phone market, but this loyalty can be affected positively or negatively. Mobile phone consumers may find it important to be rewarded for their loyalty in the repurchase processes (new product and campaign pricing) and repair service pricing. When loyal customers get the same pricing as new customers in expensive product repurchase campaigns or have a poor repair service experience, they can lose their loyalty and try a new brand. In countries like Turkey, customer loyalty can be affected by price changes resulting from foreign exchange rate volatility. Preventing the loss of loyal customers and providing a sustainable brand/customer experience depends on the ability of brands to have a data-driven tracking system for all their processes and experiences with their customers. This makes it necessary to establish data infrastructures and recording systematics that define CE processes from scratch. The recorded data must be optimized with certain statistical and data mining algorithms. Development of decision support systems (online or physical store sales support systems) by generating meaningful data on customers enable a brand-to-CRM process that is fully personalized for customers.

DATA-DRIVEN CE & DATABASE MARKETING

Today, many businesses have adopted a data-driven decision-making approach as a result of developments in “big data.” The use of business data-driven business analytics in real-time decision-making processes significant boosts business activities and performance (Sharma et al., 2014). In the same manner, marketing information systems allow monitoring and evaluating marketing processes in a full-time and data-driven manner. Thus, business and marketing managers can monitor and evaluate customers‘ experiences full-time. The use of data-driven systems to satisfy customers is increasing every day with novel approaches being developed. Customer satisfaction/loyalty strategies support long-plans for increased sales and profits (Anderson et al., 1994).

Several channels are available to monitor CE: online or physical store sales data (in-house automation), service use information, e-mails, social media accounts, websites, mobile applications and smart devices. However, once getting this data, it is difficult to use it. According to one study, only 23 percent of marketing professionals use such data to create a more relevant and actionable CE. Data can be defined as the most valuable asset that businesses have today. However, businesses need to have a strategic plan for why they need data and how they will use it, with suitable data management algorithms. Without such plans and systems, data has no significant value. Businesses cannot monitor their customers in all aspects without having a clear data management strategy and the infrastructure resources to collect and process data. If it is possible to receive, standardize and process data from various sources with a defined and strategic plan, actionable forecasts can be created for businesses. This will contribute to ensuring an optimal CE. Therefore, the data system, data optimization, and sales support system that will be used to provide CE should be based on the following targets (Akhtar, 2017):

- Determining the main objectives for using data: Each strategy must serve a purpose. Setting a goal that can be easily identified and measured is an especially important first step.

- Determining the data needed for the optimization of business targets: Three different types of data are needed for the achievement and optimization of business targets: data that defines the need, data that helps to meet the need, and data that measures the success and optimization of actions (Akhtar, 2017).

Business management must create lists of data sources and maps of data source channels according to their clearly defined targets. It may not be possible to provide all customer-oriented data from a single department. In the experience-oriented sales optimization model that is the subject of this study, there are different channels such as customer purchase data and service use data. It is necessary to plan how to turn the data related to the need into action. Corporate data should be collected, analyzed, and shared with all relevant departments according to a plan and process map. Optimization of a data system and business activities does not merely consist of a data storage technology. Moreover, it requires the right people working for the same purpose, well-defined processes, and a combination of tools.

The ultimate goal of the experience-oriented sales optimization model proposed in this article study is to optimize new purchasing preferences based on service and previous purchasing experiences. In other words, at the end of this process, different departments and people such as repair services, in-store sales support teams, and business managers will need to use data analytics.

There are a number of methods that are necessary for data analytics in a CE-oriented sales optimization model, including customer purchase history data and analytics, customer lifetime value calculations, calculation of the costs of losing customers and acquiring new customers, relationship algorithm calculations, K-means clustering method analysis and prioritization algorithm calculations.

Big data marketing (database marketing) is used to reduce corporate costs and increase customer stickiness (the same product being preferred by customers based on the value propositions of the brand or product). In addition, database marketing can be used for an effective and dynamic CRM by deeply investigating the potential value of existing customers and predicting the future demand trends of customers (Pengzhi et al., 2021). “Customer Purchase History Analysis”, “Customer Service Experience Rating”, calculation of “Customer Lifetime Value”, in terms of showing the significance of the customer for the business/brand, and “Prioritization and Relationship Algorithms” for segmentation and definition of the relations among all these calculations should be used in order to obtain a holistic CE score and group the customers within the framework of the proposed study model. When designing the model, it is important set up algorithms to perform instant calculations in an automatic format. It would be useful to develop a “computational algorithms model” in addition to the conceptual model for software development processes. Moreover, it will be possible to generate real data with accurate timing about customers after data such as internet searches and social media surveys become available to third-party businesses in the near future. This will reveal the brands/models and products which in-store sales representatives should provide more information about to customers.

CUSTOMER LIFETIME VALUE CALCULATION

Relationship marketing in CRM is based on the idea that selling a product to an existing customer is cheaper than selling the same product to a new customer, making exchanges with existing customers more profitable. Therefore, the focus is on increasing customer retention to increase profitability. Some studies suggest that a small percentage increase in current customer retention can result in a high percentage increase in profitability (Abdolvand et al., 2015; Gupta et al., 2006; Payne & Holt, 2001). But according to some research findings, the most loyal customers may not be the most profitable customers (Reinartz & Kumar, 2000). For this reason, the exchange between the customer and the brand should be measured in an experience-oriented manner.

Offering the same discount and promotional campaigns for all customer groups is not an effective way of retaining customers. In order for businesses to maintain an effective relationship with current and potential customer groups, they need to develop differing marketing and promotion strategies. Customer groups can be created by analyzing customers‘ past actions (purchase data). With the help of customer analytics, businesses can find out which customer groups provide more or less return to the business (Monalisa et al., 2019). One of the most effective analysis methods used to divide customers into groups is the Customer Lifetime Value (LTV) calculation, where LTV is a basic measurement technique in CRM that is useful for many purposes such as market segmentation, improving resource allocation, evaluating competitors, customizing marketing communications, optimizing product offer timing, and determining the market value of a business (Dahana et al., 2019; Gupta et al., 2004; Kumar et al., 2004; Kumar et al., 2006).

LTV can be defined as a quantitative measurement of the net cash flow generated by customers during the purchasing relationship with a business. This measurement method is often used by financial institutions, retail stores, telecommunications, GSM operators, and online sales platforms. It is used to identify differences between customer groups and develop the most appropriate services and policies for them. Calculating LTV accurately and grouping the customers in the right way allows the development of different marketing strategies for each customer group (Gupta & Lehmann, 2008; Hızıroğlu & Sengul, 2012).

When calculating LTV, it is important to also calculate the customer retention rate, keeping in mind the most loyal customers may not be the most profitable (Reinartz & Kumar, 2000). Customer retention is an important part of modern business strategies, as it provides an opportunity to increase customer value and reduce costs. Customer retention calculations can contain a degree of blurriness. The retention rate is easy to calculate in contractual environments, but difficult in non-contractual environments. Retention should be defined and calculated according to the business context. Retention concept and numerical values may differ according to sectors and products. For this reason, separate calculation definitions should be made for each sector and product (Abdolvand et al., 2015).

Many techniques such as mathematical algorithms, machine learning methods, statistical calculations and data mining applications can be used alone or together in LTV calculations. In accordance with the analysis purpose, exploratory methods (data mining-oriented segmentation models, etc.), or inferential methods (statistics and machine learning) can be used when estimating. Artificial neural networks, machine learning techniques, decision trees, logistic regression, classification and clustering algorithms and data mining algorithms are all used to calculate LTV (Li et al., 2021).

LTV plays a major role in campaign management, retention campaigns, credit and collection risk management, and more, but in particular, retention campaign management. There are three key components in an LTV computing model: customer‘s value over time, customer‘s length of service, and a discounting factor. Each of these components can be calculated separately and models can be combined. When modeling (calculating) LTV in the context of a customer retention campaign, it may be necessary to calculate several LTVs for each customer or customer segment corresponding to each retention campaign.

There are three factors we have to determine in order to calculate the LTV of a customer or customer group (Rosset et al., 2003). The first is the customer‘s value over time (v[t] for t ≥ 0, where t is time and t=0 is the present). In practice, the customer’s future value has to be estimated from current data, using business knowledge and analytical tools. The second is a length of service model describing the customer’s churn probability over time. This is usually described by a ‘survival’ function (S[t] for t ≥ 0), which describes the probability that the customer will still be active at time t. We can then define f (t) as the customer’s “instantaneous” probability of churn at time t (f [t] =−dS/dt). The quantity most commonly modeled, however is the hazard function (h[t] = f [t]/S[t]). Helsen & Schmittlein (1993)[A1] discuss why h(t) is a more appropriate quantity to estimate than f (t). The length of service model has to be estimated from current and historical data as well. The third factor is the discounting factor D(t), which describes how much each dollar gained in some future time (t) is worth in the present. This function is usually given based on business knowledge. Two popular choices are, Exponential decay: D(t) = exp(−at) for some a ≥ 0(a = 0 means no discounting), and Threshold function: D(t) = I(t ≤ T) for some T > 0 (where I is the indicator function). Given these three components, the formula for a customer’s LTV can be written as:

LTV= ∫_0^∞▒〖S(t)v(t)D(t)dt〗

Apart from the triple calculation formulation approach described above, there are many different variables for calculating LTV. Different calculations can be made for each industry and it may be necessary to make separate calculations and define variables for each business and product or customer segment. However, an effort to define some universal variables are summarized in table 1.

Table 1. LTV variables, adapted from Mosaddegh et al. (2021).

|

Variable |

Category |

Research |

Impact |

Type |

|

Acquisition cost |

Marketing Cost |

Ho et al., 2006 |

Negative |

Cross-industry |

|

Length of customer relationship |

Customer Loyalty |

Ekinci et al., 2014 |

Positive |

Cross-industry |

|

Average balance of customer’s demand deposits |

Activity Level |

Safari Kahreh et al., 2014 |

Positive |

Industry-specific |

|

Average transaction amount |

Monetary Value |

Gholamian & Niknam, 2012 |

Positive |

Cross-industry |

|

Churn probability |

Monetary Value |

Ho et al., 2006 |

Negative |

Cross-industry |

|

Client owns life insurance? |

Type of Products |

Haenlein et al., 2007 |

Positive |

Cross-industry |

|

Cross-sell, up-sell trends of the customer |

Monetary Value |

Ho et al., 2006 |

Positive |

Cross-industry |

|

Current property holding |

Demographic |

Ekinci et al., 2014 |

Positive |

Cross-industry |

|

Customer retention probability |

Monetary Value |

Ho et al., 2006 |

Positive |

Cross-industry |

|

Customer satisfaction expenditures |

Monetary Value |

Ho et al., 2006 |

Positive |

Cross-industry |

|

Expenditures on marketing campaigns |

Marketing Cost |

Ho et al., 2006 |

Negative |

Cross-industry |

|

Household income |

Demographic |

Ekinci et al., 2014, |

Positive |

Cross-industry |

|

Last transaction date |

Recency |

Gupta et al., 2006 |

Positive |

Cross-industry |

|

Operational cost per customer |

Monetary Value |

Gupta et al., 2006 |

Positive |

Cross-industry |

|

Operational risk (fraud, etc.) |

Monetary Value |

Ekinci et al., 2014 |

Negative |

Cross-industry |

|

Probability of customer being active |

Monetary Value |

Gupta et al., 2006 |

Positive |

Cross-industry |

|

Retention cost |

Marketing Cost |

Ho et al., 2006 |

Negative |

Cross-industry |

The customer segments created based on LTV calculations as proposed by this study will allow mobile phone companies to group their customers according to a number of elements. These elements define the customer-business relationship, such as customer analytics that define purchasing behavior, satisfaction variables related to repair services, and other services. According to these basic elements, customers who have the highest profitability for the business and those who do not have high profitability can be determined from an experiential perspective. In addition, potential customer groups with the highest return can be identified. Services and promotion efforts can offered based on the experiential data and analysis specific to the customer groups, contributing to the development of relational marketing practices. Thus, it will be possible to increase the number of loyal customer groups.

IN-STORE MARKETING

While customers often do not make purchasing decisions until they come into a physical store, there are relatively few studies on in-store marketing activities in the relevant literature. Research shows that about two-thirds of brand decisions have traditionally been made in the store during shopping (Agnew, 1987; Fam et al., 2011; McIntyre, 1995). When businesses and marketing professionals understand the factors affecting in-store decisions, they also better understand sales and customer behavior. Customers are influenced by in-store promotions, storefronts, store atmosphere, service, end of stock products, and store layout (Alvarez & Casielles, 2005; Dawes, 2004; Fam et al., 2011; Hawkins et al., 1992; Jin & Kim, 2003; Merrilees & Miller, 1996). They are also influenced by product brands, features, prices, payment options and the communication skills of sales personnel.

Competition in the retail sector is steadily increasing, with online social networks, mobile applications, and localized technologies. This complicates the purchasing processes and the customer decision-making mechanism. For example, in some categories, consumers search for products on online platforms, but the majority of purchases are made in physical stores: customers often experience the products they identify in online searches in stores (Grewal et al., 2014). Shopping in-store is a psychological behavior that includes a number of social elements, beyond merely shopping. Therefore, customer communication and guiding efforts, including in-store physical atmosphere, can significantly change purchasing behavior.

In-store marketing activities are generally carried out according to traditional customer satisfaction methods without getting to know individual customers. However, when a customer arrives at the store, they may not know which brand or model to choose. It is important for businesses and stores to contribute to the consumer’s decision-making. Creating data-driven customer profiles and instantly accessing customers’ past experiences in an information system can offer benefits to businesses. While this is currently possible in many sectors, especially for mobile purchases and mobile experiences, it cannot be used for physical store sales processes. The CE-oriented marketing information system in this study makes it possible to access various information such as purchasing behavior and service experience of each customer that walks into the store and to guide the customers accordingly.

CUSTOMER RELATIONSHIP MANAGEMENT

The traditional marketing approach focuses on acquiring new customers. However, CRM is focused on protecting current customers along with acquiring new customers (Payne et al., 1999). Accordingly, relationship-oriented marketing is an important approach that influences/increases the profitability of the business by helping to retain customers. Generally accepted approaches and research show that maintaining a business-customer relationship with a current customer is both more effective and less costly than acquiring a new customer (Payne et al., 1999; Mendoza et al., 2007; Reichheld, 1996).

CRM not only ensures the flow of information within a business but also facilitates the storage of customer data, ensuring information accessibility. It also contributes to making important forecasts about customer needs, behaviors and expectations by using the data in the database and increasing the interaction between units (Hillebrand et al., 2011; Spiller et al., 2007).

Information is obtained and transferred as a result of mutual interaction between businesses and customers. This process is the sum of processes that allow customers and businesses to interact, share information, and businesses to respond to customers. Businesses can capture information using diverse sources and channels. These sources and channels can provide data that allow businesses to learn about their customers and identify their behavior (Hillebrand et al., 2011). Customers and customer groups can be determined according to identified behaviors. Thus, businesses can develop their products and services according to the needs and expectations of customer groups and can utilize different marketing strategies according to inferences they make from such information (Chang et al., 2014).

The main assumption of the model developed in this study is that the activities for retaining current customers are at least as important as acquiring new customers. In general, businesses carry out their marketing efforts and campaigns to acquire new customers, and they allocate and spend huge marketing budgets for acquiring new customers. However, current and perhaps loyal customers cannot take advantage of new campaigns and opportunities as a result of their long-term relationship with the relevant brands. What is more, their loyalty is not rewarded. In addition, the data and experiences of current customers, such as purchasing, repair services, and re-purchasing do not get sufficient attention. Developing applications to improve communication with current customers by storing, analyzing, and converting data into personalized marketing efforts at the stages that are part of this customer journey will provide current customer satisfaction as well as reduce the likelihood of losing current customers. This model proposes to monitor the 360-degree experiences of current customers and use them in the context of customer relations.

CUSTOMER LOYALTY

Customer loyalty can be defined as the continuation of the customer journey with the current business and brand and the positive perception of this continuity by the customer. Customer loyalty can be measured by purchase repetition, positive word-of-mouth recommendations from customers and the related business/brand preferred by those who have received positive recommendations. Accordingly, customer satisfaction and loyalty are positively correlated with repurchase intentions and word-of-mouth marketing (Woo et al., 2021).

The loyalty of current customers is often rewarded with loyalty programs and they are encouraged to stay loyal with promotional efforts developed for them such as campaigns, programs, etc. The basis of a loyalty program is to provide products and services above standards to offer social status and recognition to different customer groups. These efforts enable the retention of loyal and profitable customers (Ding et al., 2021). Nowadays, however, efforts to acquire new customers have gone beyond retaining current customers, so that new customers can buy a product or service at relatively more advantageous prices and with more opportunities than current customers. This can also cause considerable damage to the loyalty of current customers.

Yang et al. (2022) nicely summarize the relationship between customer loyalty and repurchase intention. Customer loyalty is an important goal of marketing activities as it means satisfied customers and consistent sales (Kim & Ko, 2012). Therefore, repurchase intention is a key element of the relationship between customers and brands. Repurchase intention—especially by existing customers—increases loyalty, reduces marketing costs and increases sales (Helgesen, 2006). A brand may find it necessary to adjust its marketing strategy to retain valuable consumers and increase repurchase intentions (Yadav & Rahman, 2018).

Using this article’s proposed model, customers will have a higher level of satisfaction, and the probability of preferring and recommending the same business/brand will increase when customers have a customized experience and their relationship with the current business/brand is rewarded thanks to a CE-oriented data system aimed at improving customer relationships.

CONCEPTUAL MODEL DEVELOPMENT METHODOLOGY

The model developed in this study is a conceptual model that also represents marketing information system architecture and design. In this section, the conceptual model development approach is introduced and the required steps for developing a marketing information system are explained.

In the process of developing a software or information system, conceptual model development is usually utilized and implementation capabilities are not displayed. However, according to Cook (1999), engineers do not have problems during solution coding with a specific goal. Rather, the problem often arises when determining which codes are for which goals and solutions. In the process of developing software focused on the goal, requirements, verification and approval processes, the coding part is automatically solved. Creating a conceptual model in this process offers significant advantages in proceeding in the right direction (Cook, 1999; Pace, 2000).

The conceptual model is a collection of information that defines a software developer’s concept of a simulation and its parts. This conceptual model describes what the software will represent (entities, actions, tasks, processes, interactions, etc.) and explains how to meet software requirements (in terms of assumptions, algorithms, features, relationships, and data). The clearer and more precise the conceptual model is, the more fully a piece of software meets its requirements (Pace, 2000). A structured six-step approach can be used to develop a Marketing Information System (Lin & Hong, 2009):

- Marketing systems planning: Business senior management should have an unclouded vision to provide the desired values expected by customers and the business in order to implement a strategy that is designated for the development of marketing activities. A vision is necessary to ensure the consistency of marketing goals, determined by asking business/marketing managers about the use and media of information sources, goals, decision-making processes, and data needs (Harris & Goode, 2004).

- Marketing process analysis: Automating business and commercial processes requires careful analysis and planning. Business processes show how a particular business is conducted and the relationship between the relevant activity of the business and the paths necessary to coordinate the business (Laudon & Laudon, 2003). At this stage, the right set of business processes is selected for the beginning, and areas requiring automation are determined (Herbst & Karagiannis, 2000).

- Marketing information system architecture development: A well-designed system architecture provides a roadmap for the system creation process. Putting system components into perspective, it defines the functions of system components and describes how they interact with each other.

- Marketing information system analysis and design: The focus of system analysis is to determine the requirements for a new system. At the system design stage, a new or alternative information system is created, software and hardware are developed and the system is tested. The design involves an understanding of the area of interest. Design specifications are used as a blueprint for the implementation of the system (Nunamaker et al., 1990).

- Creating a marketing information system: By creating a prototype, various problems that arise in the developed system can be addressed. For example, new user interface design problems can be evaluated. The prototype can be used to solve various problems and learn more about the concepts, framework, and design throughout the system creation process.

- Marketing information system control: The use of the prototype system can be observed through case studies. After the prototype is installed, it can be tested and evaluated. The system is checked to ensure it is working correctly and meets the specified requirements.

In this study, the architecture and design of a marketing information system are presented alongside a conceptual model. The information system model is designed to allow the analysis of CE processes in a mobile phone business, to assist in-store sales development efforts and to maintain an effective CRM system with customer loyalty, monitoring current customers with an experience-oriented approach.

CONCEPTUAL MODEL FOR CRM WITH CE-ORIENTED DATA OPTIMIZATION

The model is built on tracking the customers the mobile phone business has a relationship with separately and continually, grouping and categorizing them based on the level of return they provide to the business, on customer experiences, and developing new and innovative offers to current customers outside merely market price and campaigns.

Figure 2.

The main actions for implementing the identified CE-Oriented Sales Optimization Model for Mobile Phone Businesses can be summarized as follows:

- The cost required to acquire a customer can be calculated and this cost can be waived if a current customer repurchases their current brand again. Thus, the lifetime business values of current customers are increased for the long term. In addition, an increase in the level of customer satisfaction can be achieved with customization.

- Customers’ product and service experiences should be evaluated according to new, simple, and realistic criteria. Thus, customer dissatisfaction can be managed with an activity-based and solution-oriented approach.[2] Here, customers may report dissatisfaction in a way that helps them profit from this system. The model is considered to be harmless to the brand even in this situation. The model is forecasted to offer a solution where everyone benefits, as the main point between the brand and the customer is that the customer feels special, and the brand maintains long-term customer relationships.

- Customer behavior can be associated with a holistic view using customer codes in the purchasing and service processes. The crucial point in this system is to track each customer from a single platform with separate code numbers. Thanks to these code numbers, each behavior of the customer is recorded and associated on the system.

- Customers will be separated into groups based on innovative criteria from their purchasing processes and service experiences. These groups will allow customers to be monitored from two different perspectives:

- ‘Gold’ customers who regularly make purchases and have a positive service experience should not be lost to competition offerings as a result of their experiences with the brand.

- Ensuring that a current ‘bronze’ customer who has had a one-time interaction is not lost to a competing company as a result of service and product dissatisfaction.

- Defining campaigns and opportunities that apply to customers, who have been assigned a code, in their new product preferences according to the relationship scores (classification) between their purchasing behavior and customer experience of the product, customer service, and repair services.

- In a format integrated with the sales system in stores and using customer names and surnames, exclusive deals apart from other general campaigns will be instantly available to current customers in real-time in the store.

- Including solution policies in campaigns within the framework of customer satisfaction, taking into account product and repair service errors that are not defined within the scope of the warranty, but have arisen during the process.

[2] Most of customer services are carried out as customer distraction activities under call centers without taking any authority and responsibility. When customers call a business, they want to solve a problem. This is why it is important to establish activity-based and solution-oriented interactive customer services.

DISCUSSION

In general, brands can either provide product experience in a virtual environment with the help of current technological developments (virtual reality, etc.) or perform CE with test uses before product purchase. However, the important thing is customers’ post-purchase product usage experiences, customer service received and post-purchase service experiences. It is difficult to say that businesses carefully examine users’ actual experience processes and make decisions based on these experiences. However, the most important factor that leads a customer to prefer the same brand or product again is the real-time product experience process. For this reason, businesses—especially mobile phone companies—need to create defined processes for monitoring, testing and measuring real-time CE processes. This mobile phone will also contribute to the establishment of the right interaction between the customers and the brands through the right channel. While businesses can carry out activities related to pre-purchase processes, purchasing processes and some services, the processes of a product such as product development, design and after-sales services are directly related to the analysis of real-time CE. In this way, businesses can carry out effective activities to retain their existing customers by correctly analyzing the priorities of their customers and the problems they experience with the product or brand. With the data-based model proposed in this article, it will be possible for businesses to monitor their customers in an experience-oriented manner. In this way, businesses will have the potential to retain their existing customers in an intensely competitive environment.

CONCLUSION

The difficulties of having a negative service experience but retaining a desire to repurchase the same product brand again despite this generated the starting point for this research. In general, the loyalty of customers who purchase regularly are ignored during repurchase processes, whereas new customers are offered campaigns, and there is no difference between new customers and loyal customers for brands. Based on these findings and negative experiences, the conclusion was that businesses should monitor their current customers in real-time in all processes, and this can be achieved with data-driven process planning; thus, a data optimization model systematic was introduced.

Within the scope of this study, a customer-brand experience-oriented data system has been defined in order to ensure customer satisfaction and loyalty. Examples of possible analysis methods to be used, by creating a conceptual process map and algorithm of this data systematics, were presented. The main purpose of this study is to determine the impact of CE processes on business profitability and to implement a data systematics-oriented configuration of this process for mobile phone businesses. The proposed data optimization process model has a structure that can be used for all businesses, however. All businesses should monitor their customers’ experiences of their brands and products and should develop attractive campaigns and promotion efforts to loyal customer groups similar to the efforts applied to acquire new customers.

Businesses will also have the potential to perform product and sales development activities in a data-driven manner based on customer purchase or repair service experiences. The statistical analysis and data mining processes of this model can be discussed in detail in future studies. In addition, database structure and software processes can be improved by incorporating a software and engineering point of view into future.

REFERENCES

Abdolvand, N., Baradaran, V., & Albadvi, A. (2015). Activity–level as a link between customer retention and consumer lifetime value. Iranian Journal of Management Studies, 8(4), 567-587. https://ssrn.com/abstract=3926586

Agnew, J. (1987). P-O-P displays are becoming a matter of consumer convenience. Marketing News.

Akhtar, O. (2017). Creating a Data-Driven Strategy for Customer Experience. ALTIMETER @Prophet. https://rpmadv.com/wp-content/uploads/2018/06/ Altimeter_Data_Driven_CX_Strategy_Omar_Akhtar.pdf

Alexander, B., & Kent, A. (2022). Change in technology-enabled omnichannel customer experiences in-store. Journal of Retailing and Consumer Services, 65, 102338. https://doi.org/10.1016/j.jretconser.2020.102338

Alvarez, A.B. and Casielles, R.V. (2005), “Consumer Evaluations of Sales Promotion: the Effect on Brand Choice”, European Journal of Marketing, Vol. 39 No. 1, pp. 54‐70.

Anderson, E. W., Fornell, C., & Lehman, D. (1994). Customer satisfaction, market share, and profitability: findings from Sweden. Journal of Marketing, 3(58), 53-66. https://doi.org/10.1177/002224299405800304

Brodie, R. J., Ilic, A., Juric, B., & Hollebeek, L. (2013). Consumer engagement in a virtual brand community: an exploratory analysis. Journal of Business Research, 66(1), 105-114. https://doi.org/10.1016/j.jbusres.2011.07.029

Chang, H., Wong, K., & Fang, P. (2014). The effects of customer relationship management relational information processes on customer-based performance. Decision Support Systems, 66, 146-159. https://doi.org/10.1016/j.dss.2014.06.010

Chauhan, S., Akhtar, A., & Gupta, A. (2022). Customer experience in digital banking: a review and future research directions. International Journal of Quality and Service Sciences, 14(2), 311-348. https://doi.org/10.1108/IJQSS-02-2021-0027

Cook, D. (1999). Evolution of Programming Languages and Why a Language is Not Enough to Solve Our Problems. http://lsc.fie.umich.mx/~juan/Materias/FIE/Lenguajes/Slides/Papers/Evolution.html

Dahana, W. D., Miwa, Y., & Morisada, M. (2019). Linking lifestyle to customer lifetime value: An exploratory study in an online fashion retail market. Journal of Business Research, 99, 319–331. https://doi.org/10.1016/j.jbusres.2019.02.049

Dawes, J. (2004), “Assessing the Impact of a Very Successful Price Promotion on Brand, Category and Competitor Sales”, Journal of Product & Brand Management, Vol. 13 No. 5, pp. 303‐14.

Ding, A., Legendre, T. S., Han, J., & Chang, H. (2021). Freedom restriction and non-member customers’ response to loyalty programs. International Journal of Hospitality Management, 94, 102809. https://doi.org/10.1016/j.ijhm.2020.102809

Ekinci, Y., Uray, N., & Ülengin, F. (2014). A customer lifetime value model for the banking industry: a guide to marketing actions. European Journal of Marketing.

Fam, K., Merrilees, B., Richard, J. E., Jozsa, L., Li, Y., & Krisjanous, J. (2011). In-store marketing: a strategic perspective. Asia Pacific Journal of Marketing and Logistics, 23(2), 165-176. https://doi.org/10.1108/13555851111120470

Gholamian, M. R., & Niknam, Z. (2012). An Adapted Pattern for Customer Segmentation in Retail Banking Based on Customer Lifetime Value, Journal of Executive Management, 4 (7), pp. 59-76

Grewal, D., & Roggeveen, A. (2020). Understanding Retail Experiences and Customer Journey Management. Journal of Retailing, 96(1), 3–8. https://doi.org/10.1016/j.jretai.2020.02.002

Grewal, D., Roggeveen, A., & Nordfalt, J. (2014). Shopper marketing & in-store marketing: an introduction. Review of Marketing Research, 11. https://doi.org/10.1108/S1548-643520140000011016

Gupta, S., Hanssens, D., Hardie, B., Kahn, W., Kumar, V., Lin, N., Ravishanker, N., & Sriram, S. (2006). Modeling customer lifetime value. Journal of Service Research, 9(2), 139-155. https://doi.org/10.1177/1094670506293810

Gupta, S., & Lehmann, D. R. (2008). Models of Customer Value. Springer. https://doi.org/10.1007/978-0-387-78213-3_8

Gupta, S., Lehmann, D. R., & Stuart, J. A. (2004). Valuing Customers. Journal of Marketing Research, 41(1), 7–18. https://doi.org/10.1509/jmkr.41.1.7.25084

Haenlein, M., Kaplan, A. M., & Beeser, A. J. (2007). A model to determine customer lifetime value in a retail banking context. European Management Journal, 25(3), 221-234.

Harris, L. C., & Goode, M. (2004). The four levels of loyalty and the pivotal role of trust: A study of online service dynamics. Journal of Retailing, 80(2), 139–158. https://doi.org/10.1016/j.jretai.2004.04.002

Hauser, J. R., Simester, D. I., & Wernerfelt, B. (1994). Customer Satisfaction Incentives. Marketing Science, 13(4), 327–350. https://doi.org/10.1287/mksc.13.4.327

Hawkins, D., Best, R. and Coney, K. (1992), Consumer Behaviour, Irwin, Homewood IL.

Helgesen, Ø. (2006). Are loyal customers profitable? Customer satisfaction, customer (Action) loyalty and customer profitability at the individual level. Journal of Marketing Management, 22(3–4), 245–266. https://doi.org/10.1362/026725706776861226

Helsen, K. and Schmittlein, D.C. 1993. Analyzing Duration Times in Marketing: Evidence for the Effectiveness of Hazard Rate Models. Marketing Science, 11:395–414

Herbst, J., & Karagiannis, D. (2000). Integrating machine learning and workflow management to support acquisition and adaptation of workflow models. Intelligent Systems in Accounting, Finance and Management, 9(2), 67–92.

Hillebrand, B., Nijholt, J. J., & Nijssen, E. J. (2011). Exploring CRM effectiveness: An institutional theory perspective. Journal of the Academy of Marketing Science, 39(4), 592–608. https://doi.org/10.1007/s11747-011-0248-3

Hiziroğlu, A., & Sengul, S. (2012). Investigating Two Customer Lifetime Value Models from Segmentation Perspective. Procedia - Social and Behavioral Sciences, 62, 766–774. https://doi.org/10.1016/j.sbspro.2012.09.129

Ho, T., Park, Y., Zhou, Y. (2006) Incorporating Satisfaction İnto Customer Value Analysis: Optimal Investment in Lifetime, Marketing Science, 25 (3), pp. 260-277

Ittner, C., & David, L. (1998). Are nonfinancial measures leading indicators of financial performance? An analysis of customer satisfaction. Journal of Accounting Research, 1(1), 1-35. https://doi.org/10.2307/2491304

Jin, L., He, Y., & Zhang, Y. (2014). How Power States Influence Consumers’ Perceptions of Price Unfairness. Journal of Consumer Research, 40(5), 818–833. https://doi.org/10.1086/673193

Jin, B. and Kim, Jai‐O (2003), “A typology of Korean discount Shoppers: Shopping Motives, Store Attributes, and Outcomes”, International Journal of Service Industry Management, Vol. 14 No. 4, pp. 396‐419.

Jocevski, M., Arvidsson, N., Miragliotta, G., Ghezzi, A., & Mangiaracina, R. (2019). Transitions Towards Omni-channel Retailing Strategies: a Business Model Perspective. International Journal of Retail & Distribution Management, 47(2), 78-93. https://doi.org/10.1108/IJRDM-08-2018-0176

Kim, A. J., & Ko, E. (2012). Do social media marketing activities enhance customer equity? An empirical study of luxury fashion brand. Journal of Business Research, 65(10), 1480–1486. https://doi.org/10.1016/j.jbusres.2011.10.014

Kimes, S. E. (1994). Perceived Fairness of Yield Management: Applying yield-management principles to rate structures is complicated by what consumers perceive as unfair practices. Cornell Hotel and Restaurant Administration Quarterly, 35(1), 22–29. https://doi.org/10.1177/001088049403500102

Knutson, B. J., Beck, J. A., Kim, S. H. & Cha, J. (2007). Identifying the dimensions of the experience construct. Journal of Hospitality and Leisure Marketing, 15(3), 31-47. https://doi.org/10.1300/J150v15n03_03

Komulainen, H. & Saraniemi, S. (2019). Customer centricity in mobile banking: a customer experience perspective. International Journal of Bank Marketing, 37(5), 1082-1102. https://doi.org/10.1108/IJBM-11-2017-0245

Kumar, V., Lemon, K. N., & Parasuraman, A. (2006). Managing Customers for Value: An Overview and Research Agenda. Journal of Service Research, 9(2), 87–94. https://doi.org/10.1177/1094670506293558

Kumar, V., Ramani, G., & Bohling, T. (2004). Customer lifetime value approaches and best practice applications. Journal of Interactive Marketing, 18(3), 60–72. https://doi.org/10.1002/dir.20014

Laudon, K., & Laudon, J. (2003). Management Information Systems: New Approaches to Organization and Technology. Prentice Hall.

Lemon, K. N., & Verhoef, P. C. (2016). Understanding Customer Experience Throughout the Customer Journey. Journal of Marketing, 80(6), 69–96. https://doi.org/10.1509/jm.15.0420

Li, Y., Hou, B., Wu, Y., Zhao, D., Xie, A., & Zou, P. (2021). Giant fight: customer churn prediction in traditional broadcast industry. Journal of Business Research, 131, 630-639. https://doi.org/10.1016/j.jbusres.2021.01.022

Lin, C., & Hong, C. (2009). Development of a marketing information system for supporting sales in a tea-beverage market. Expert Systems with Applications, 36(3), 5393–5401. https://doi.org/10.1016/j.eswa.2008.06.056

Mbama, C. I., Ezepue, P., Alboul, L., & Beer, M. (2018). Digital banking, customer experience and financial performance: UK bank managers’ perceptions. Journal of Research in Interactive Marketing, 12(4), 432-451. https://doi.org/10.1108/JRIM-01-2018-0026

McIntyre, P. (1995). Brand Loyalty Continues to Slide. Financial Review. https://www.afr.com/companies/media-and-marketing/brand-loyalty-continues-to-slide-19951003-k6n0w

Mendoza, L. E., Marius, A., Pérez, M., & Grimán, A. C. (2007). Critical success factors for a customer relationship management strategy. Information and Software Technology, 49(8), 913–945. https://doi.org/10.1016/j.infsof.2006.10.003

Merrilees, B. and Miller, D. (1996), Retailing Management: A Best Practice Approach, RMIT Press, Melbourne.

Moliner-Tena, M., Monferrer-Tirado, D., & Estrada-Guillén, M. (2019). Customer engagement, non-transactional behaviors and experience in services: a study in the bank sector. International Journal of Bank Marketing, 37(3), 730-754. https://doi.org/10.1108/IJBM-04-2018-0107

Monalisa, S., Nadya, P., & Novita, R. (2019). Analysis for Customer Lifetime Value Categorization with RFM Model. Procedia Computer Science, 161, 834–840. https://doi.org/10.1016/j.procs.2019.11.190

Morgan, N., Eugene, W., & Vikas, M. (2005). Understanding firms’ customer satisfaction information usage. Journal of Marketing, 69(3), 131-151. https://doi.org/10.1509/jmkg.69.3.131.66359

Mosaddegh, A., Albadvi, A., Sepehri, M. M., & Teimourpour, B. (2021). Dynamics of customer segments: A predictor of customer lifetime value. Expert Systems with Applications, 172, 114606.

Nunamaker, J. F., Chen, M., & Purdin, T. D. M. (1990). Systems Development in Information Systems Research. Journal of Management Information Systems, 7(3), 89–106. https://doi.org/10.1080/07421222.1990.11517898

Pace, D. K. (2000). Ideas About Simulation conceptual model development. Johns Hopkins Apl Technical Digest, 21, 327-336.

Payne, A. & Holt, S. (2001). Diagnosing customer value: integrating the value process and relationship marketing. British Journal of Management, 12(2), 159-182. https://doi.org/10.1111/1467-8551.00192

Payne, A., Christopher, M., Clark, M., & Peck, H. (1999). Relationship Marketing for Competitive Advantage. Butterworth Heinemann.

Pengzhi, Y., Hao, H., Mengxuan, Z., & Ying, Z. (2021). Application of big data marketing in customer relationship management. ICEBT ‘21: Proceedings of the 2021 5th International Conference on E-Education, E-Business and E-Technology. Association for Computing Machinery. https://doi.org/10.1145/3474880.3474882

Puccinelli, N. M., Goodstein, R. C., Grewal, D., Price, R., Raghubir, P., & Stewart, D. (2009). Customer Experience Management in Retailing: Understanding the Buying Process. Journal of Retailing, 85(1), 15–30. https://doi.org/10.1016/j.jretai.2008.11.003

Reichheld, F. (1996). The Loyalty Effect. Harvard Business School Press.

Reinartz, W. J. & Kumar, V. (2000). On the profitability of long-life customers in a noncontractual setting: an empirical investigation and implications for marketing. Journal of Marketing, 64(4), 17-35. https://doi.org/10.1509/jmkg.64.4.17.18077

Rosset, S., Neumann, E., Eick, U., & Vatnik, N. (2003). Customer Lifetime Value Models for Decision Support. Data Mining and Knowledge Discovery, 7(3), 321–339. https://doi.org/10.1023/A:1024036305874

Safari Kahreh, M., Tive, M., Babania, A., & Hesan, M. (2014). Analyzing the applications of customer lifetime value (CLV) based on benefit segmentation for the banking sector. Procedia-Social and Behavioral Sciences, 109, 590-594.

Saleh, K. (2021, May 16). The New Customer Journey: A Convergence of Content, Context, Channels and Commerce [Blog post]. Invesp. https://www.invespcro.com/blog/the-new-customer-journey-a-convergence-of-content-context-channels-and-commerce/

Sarmah, B., Kamboj, S., & Kandampully, J. (2018). Social media and co-creative service innovation: an empirical study. Online Information Review, 42(7), 1146-1179. https://doi.org/10.1108/OIR-03-2017-0079

Schmitt, B. (2003). Customer Experience Management: A Revolutionary Approach to Connecting With Your Customers. The Free Press.

Sharma, R., Mithas, S., & Kankanhalli, A. (2014). Transforming decision-making processes: A research agenda for understanding the impact of business analytics on organisations. European Journal of Information Systems, 23(4), 433–441. https://doi.org/10.1057/ejis.2014.17

Sığırcı, Ö., & Gegez, A. (2019). Avantajlı fiyat her zaman adil algılanır mı? müşteri kimliği bazlı farklılaştırılmış fiyatlandırma, müşteri grubu ve para iadesinin etkileri. Pazarlama ve Pazarlama Araştırmaları Dergisi, 21-53.

Spiller, J., Vlasic, A., & Yetton, P. (2007). Post-adoption behavior of users of Internet Service Providers. Information & Management, 44(6), 513–523. https://doi.org/

10.1016/j.im.2007.01.003

Stein, A., & Ramaseshan, B. (2016). Towards the identification of customer experience touch point elements. Journal of Retailing and Consumer Services, 30, 8–19. https://doi.org/10.1016/j.jretconser.2015.12.001

Verhoef, P. C., Lemon, K. N., Parasuraman, A., Roggeveen, A., Tsiros, M., & Schlesinger, L. (2009). Customer experience creation: determinants, dynamics and management strategies. Journal of Retailing, 85(1), 31-41. https://doi.org/10.1016/j.jretai.2008.11.001

Waqas, M., Hamzah, Z. L. & Mohd Salleh, N. A. (2021). Customer experience with branded content: a social media perspective. Online Information Review, 45(5), 964-982. https://doi.org/10.1108/OIR-10-2019-0333

Woo, H., Kim, S. J., & Wang, H. (2021). Understanding the role of service innovation behavior on business customer performance and loyalty. Industrial Marketing Management, 93, 41–51. https://doi.org/10.1016/j.indmarman.2020.12.011

Yadav M., & Rahman Z. (2018). The influence of social media marketing activities on customer loyalty. Benchmarking: An International Journal, 25(9), 3882–3905. https://doi.org/10.1108/bij-05-2017-0092

Yang, Q., Hayat, N., Al Mamun, A., Makhbul Z. K. M., & Zainol N. R. (2022). Sustainable customer retention through social media marketing activities using hybrid SEM-neural network approach. PLoS ONE, 17(3), e0264899. https://doi.org/10.1371/journal.pone.0264899