ABSTRACT

This article focuses on stakeholder corporate social responsibility (CSR) to predict the corporate image (CI) of banking users in Myanmar. Each dimension of stakeholder CSR was applied from a consumer perspective. A structured questionnaire was used to collect data using convenience sampling. Five hundred and seventy-four valid responses were received from banking users and were analyzed using a structural equation model. The results showed a positive and significant relationship between CSR’s four dimensions: CSR targeted at social and non-social stakeholders, at customers, at employees, and at government and CI. CSR targeted at customers was most influential on CI, while CSR targeted at social and non-social stakeholders was the least influential. These results should be used by banks to effectively design and implement CI through application of the stakeholder CSR model.

Keywords: Corporate social responsibility, Corporate image, Stakeholder.

INTRODUCTION

Corporate social responsibility (CSR) has evolved since the late twentieth century and is regarded as a strategic tool by the top management teams of many firms (Mubarak et al., 2019). CSR refers to business activities that emphasize the wellbeing of society rather than only profit maximization (Eells & Walton, 1969). The banking industry, in particular, has increased its focus on CSR in recent years (Bednarska-Olejniczak, 2017) with its activities tending to incorporate a long-term, rather than short-term, perspective (Dorota, 2016). The scholarly and marketing literature on CSR is voluminous, including explorations of CSR from a consumer perspective (Maruf, 2013).

The use of CSR by an organization has many benefits. It can create strong links with the community and when practiced well, firms can capture a position in the marketplace (Mubarak et al., 2019)Customers’ awareness of CSR is critical in increasing firm value and building reputation among customers (Servaes & Tamayo, 2013). CSR leads to business success by creating an attractive corporate image (CI) and providing competitive advantage and differentiation (Maruf, 2013). It can also affect corporate reputation, customer loyalty, and trust (Stanaland et al., 2011).

Since a bank’s success relies considerably upon customer trust and confidence, CI is a valuable intangible asset that can improve public confidence conditions and attract new customers (Amaka, 2012). Building a solid brand and favorable CI is a critical tool for banks to achieve a competitive advantage in the market (Bednarska-Olejniczak, 2017). CI is a primary factor in an organization’s success or failure and CSR is a tool to improve CI (Worcester, 2009). CSR initiatives affect customer buying behavior and significantly impact their evaluation of companies (Sen & Bhattacharya, 2001) and corporate reputation conditions (Fatma et al., 2015).

The banking sector in Myanmar is useful to study in regard to consumer perception of CSR and CI for two main reasons. First, Myanmar domestic companies’ awareness of CSR is not too different from those of foreign counterparts (Barkemeyer & Miklian, 2019). Among the top four companies conducting sustainability and CSR in Myanmar, two operate banking businesses (Minyin, 2018). It can be assumed that banks’ CSR programs and actions are significant to company operations in Myanmar. Second, banking products have a low level of differentiation (Pomering & Dolnicar, 2009) and there has been intense competition in Myanmar since the Central Bank of Myanmar allowed foreign banks to operate (Htin Lynn Aung, 2019). Thus, CSR, CI and intangible factors are important to competition (Bednarska-Olejniczak, 2017).

According to Dorota (2016), banks’ CSR activities positively impact CI. However, research on the relationship between CSR activities and CI is rare in Myanmar, a developing country. Therefore, to fill this research gap, this article applies a CSR model from a stakeholder perspective to predict bank consumers’ CI. This study applies each stakeholder CSR dimension to know their effect on CI by conceptualizing the four dimensions of CSR according to Turker (2009) and the six dimensions of CI adopted from LeBlanc & Nguyen (1996). This article aims to examine whether and how each dimension of CSR impacts the CI of banking users. In doing so, it renders CSR an antecedent of CI. It describes CSR and stakeholder CSR, including its popular conceptualizations. It also explains the dimensions of CI and discusses the impact of CSR on CI in detail.

LITERATURE REVIEW AND HYPOTHESES

It is not simple to describe CSR with one universal definition, although scholars have attempted it for some time (Turker, 2009). CSR has been defined as a corporations’ accountability regarding the impact of their activities on a respective community and environment (Frederick et al., 1992). Kotler & Lee defined CSR as a commitment to promote human beings’ and the environment’s best interest through voluntary business activities and enterprise resource usage (2004). Turker defined CSR as corporate behaviors that affect stakeholders and contribute beyond profit maximization (2009).

Regarding the conceptualization and measurement of CSR, three main approaches to articulating it exist (Glaveli, 2020). First is the Carroll model which consists of four factors: economic, legal, ethical, and philanthropic, which are duties of firms to fulfil (1979). Second is sustainability CSR, which includes economic, social, and environmental elements as a three-dimensional construct. Third is stakeholder CSR (Freeman, 1984). This approach describes firms as responsible for general wellbeing, including that of customers, employees, shareholders, wider society, the environment, and the market (Decker, 2004).

STAKEHOLDER CSR

Stakeholder CSR can be defined as a relationship between a firm and stakeholders, which involves a significant relationship with society as a whole (Crowther & Shahla, 2021). The stakeholder perspective has a natural fit with CSR by focusing on particular groups or persons concerned with the business’ activities (Carroll, 1991). While there is no commonly accepted definition of “stakeholder” in the literature (Turker, 2009), a stakeholder can be referred to as a person or a group affected by attaining an organizational goal or affecting its actions (Werther & Chandler, 2010). There are four dimensions of stakeholder CSR, which are CSR to social and non-social stakeholders, CSR to employees, CSR to customers, and CSR to government (Turker, 2009). Future generations and non-government organizations are committed to sustainable development that includes the natural environment and this common desire for the well-being of present and future generations identifies them as social or non-social stakeholders (Turker, 2009).

CSR to customers involves fairness in determining prices, an entire comprehensive label to describe products and services, safety, and product quality (Öberseder et al., 2014). CSR to employees is concerned with appropriate working situations, implementation of non-discrimination policies, adequate compensation, and a fair reward system (Öberseder et al., 2014). CSR to government is related to compliance with the law and regulations and paying taxes (Moisescu, 2017; Turker, 2009).

CORPORATE IMAGE

CI results from an aggregate of experience, impressions, beliefs, perceptions, and knowledge people have about a firm (Worcester, 1997). Therefore, CI has two parts – the functional and the emotional. The first is concerned with tangibility, such as quality, reliability, service offering, and price. The second one is related to subjective feelings (Sherril, 1977). CI depends on the perception of particular groups of people, their practical knowledge of and contact with a specific company (Flavián et al., 2004). It is assumed that CI is a consumer’s reaction to a company’s overall service offering, business name, and corporate culture (Nguyen, 2006).

LeBlanc and Nguyen describe six dimensions that potentially influence customer perception of CI for service-oriented firms (1996): corporate identity, reputation, service offering, access to service, physical environment, and contract personnel. Corporate identity is how a standard organizational style combines with a unique character and distinctive personality (Downey, 1986). Corporate identity is critical because it is the corporation’s personality and soul (Anspach & Lee, 1983). Due to the intangibility of services, reputation is a subset of CI (LeBlanc & Nguyen, 1996). Reputation is an expected consistent action in a particular way (Herbig et al., 1994). The delivery of credible management behavior that consumers believe a firm has promised results in its reputation (Hart, 1988). LeBlanc and Nguyen indicate that management is critical in formulating corporate reputation through actions focused on customer needs such as like effective leadership style, exemplary character, and appropriate culture (1996).

Contract personnel is a crucial CI element as employees are the first point of contract for consumers (Nguyen, 2006). Customer contact, employee performance, and interaction quality affected service quality (Heskett, 1987). The service offerings a customer receives enable them to form a positive image of a firm (Dowling, 1993). Service offerings consist of core services and regard the reasons why consumers decide to make purchases, as well as adjunct services that value-add on core services (Eiglier & Langeard, 1987).

Access to services means providing services promptly and on time (LeBlanc & Nguyen, 1996). Management needs to provide an appropriate mix of services to customers in a timely and responsive manner (Parasuraman, et al., 1988). Waiting time for services negatively affects service evaluation (Taylor, 1994) and CI, especially for financial service providers (LeBlanc & Nguyen, 1996). The physical environment where service production and consumption occur seem to affect the perception of CI (LeBlanc & Nguyen, 1996). The physical environment—ambient situation, spatial layout and decoration and orientation form—enables firms to influence behavior and communicate CI to consumers (Bitner, 1992).

RELATIONSHIP BETWEEN CSR AND CORPORATE IMAGE

Companies using CSR practices have had positive evaluations by customers (Chen et al., 2012). CSR affected CI formation in customers’ minds (Gürleket al., 2017) and enabled firms to capture a reliable, competitive advantage (Porter & Kramer, 2006). According to Gürlek et al., consumers’ firm belief in a company’s CSR actions could positively impact its CI (2017). Zhang & Cui Yu found that when a company is devoted to CSR activities, consumers were more likely to believe that the company had a positive CI (2018), and many companies emphasize CSR activities to create a positive CI (Chang, 2007).

Previous research indicates that CSR is a predictor of CI from a consumer behavior perspective. CSR affects consumer perception of CI in different industry settings (Arendt & Brettel, 2010). CSR is a critical factor affecting CI in various industries including fashion (Zhang & Cui Yu, 2018), bicycles (Wang, 2020), hospitality (Gürlek et al., 2017), petroleum (Meechoobot & Rittippant, 2015) and aviation (Lee et al., 2019). Other research shows that CSR is crucial in predicting CI in the banking industry (Dorota, 2016; Mubarak et al., 2019).

Environmental activities affect CI significantly (Yadav et al., 2016) and activities for the welfare of next-generation have a critical impact on CI (Mukonza & Swarts, 2020). Providing employees’ interest leads to CI (Semnani et al., 2015). Fulfilling customers’ service expectations improves CI (Kant et al., 2017). A firm following laws and regulations and paying taxes also improves CI (Kim et al., 2020; Lee, 2019; Mubarak et al., 2019).

Therefore, this article proposes four related hypotheses:

H1: CSR targeted at social and non-social stakeholders positively impacts CI.

H2: CSR targeted at employees positively impacts CI.

H3: CSR targeted at customers positively impacts CI.

H4: CSR targeted at government positively impacts CI.

RESEARCH METHODOLOGY

A structured questionnaire was applied to examine the proposed hypotheses. The questionnaire was divided into two sections. The first included questions about respondents’ demographic details. The second consisted of fifty questions answered using a five-point Likert scale about the primary constructs involved in this study’s proposed model. The items for CSR were adopted from Maignan et al. (1999), Wagner et al. (2008), Turker (2009), and Öberseder et al. (2014), while those for CI were adopted from Evans (1979), Mandel et al. (1981), LeBlanc & Nguyen (1996), Yavas et al. (2004) and Flavián et al. (2005).

Before a pilot test was conducted, the questionnaire was translated from English to Myanmar using back-translation. A pilot test collected data from thirty respondents. Reliability and exploratory factor analysis was applied as preliminary analysis in the pilot test. Based on the initial pilot test results, the final questionnaire was updated before primary data collection. The study population were Myanmar Payment Union (MPU) users, which number 10.5 million in the country (Salai Tun, 2020). The sample selected for the study involved banking users from Mandalay who had MPU cards supplied by CB Bank, the third-biggest bank in Myanmar. The target respondents were determined using the convenience sampling method. Six hundred banking users were asked to complete a structured online survey using Google Forms which was shared on Facebook during March and April 2020. A total of 574 usable and valid responses were received after screening out incomplete and invalid responses. Confirmatory Factor Analysis (CFA) was applied to test the instrument’s convergent validity and reliability, and Structural Equation Modeling (SEM) was used to test the theoretical model and hypotheses. SEM is an analysis method used to estimate a series of dependence relationships among a set of concepts or constructs represented by multiple measured variables and incorporated into an integrated model (Malhotra et al., 2017).

RESULTS

Results showed that 59.8 percent of respondents were female, that 70.4 percent were aged between 20 and 30 years, and that 38.9 percent of respondents were private staff. Moreover, 352 (61.3 percent) of respondents were graduates and 283 (49.3 percent) had a monthly income of between 150,000 and 300,000 Myanmar Kyat.

Composite reliability (CR), the average variance extracted (AVE), and maximum shared variance (MSV) were calculated to evaluate the reliability of the measurement model. The composite reliabilities, ranging from 0.799 to 0.938, were above the cutoff level of 0.70 (Hair et al., 2010). The AVE values of the factors were higher than 0.5, which were above the cutoff level of 0.50 (Hair et al., 2010). As shown in table 1, the MSV is less than the AVE, establishing the discriminant validity among the variables of the study (Hair et al., 2010). For testing scale reliability, Cronbach’s alpha (CA) was applied. In the main study, the values of CA of all constructs were above 0.7, ranging from 0.773 to 0.910, a result that indicates outstanding reliability (Zikmund, 2010).

Table 1

|

Constructs |

CR |

AVE |

MSV |

CA |

|

CSR to Customer |

0.864 |

0.579 |

0.689 |

0.864 |

|

CSR to Social and Non-social |

0.865 |

0.581 |

0.537 |

0.862 |

|

CSR to Employee |

0.881 |

0.598 |

0.537 |

0.875 |

|

CSR to Government |

0.913 |

0.679 |

0.716 |

0.910 |

|

Service Offering |

0.938 |

0.791 |

0.560 |

0.895 |

|

Contact Personnel |

0.874 |

0.634 |

0.624 |

0.895 |

|

Access to Service |

0.835 |

0.629 |

0.624 |

0.868 |

|

Physical Environment |

0.855 |

0.597 |

0.578 |

0.885 |

|

Corporate Identity |

0.799 |

0.501 |

0.230 |

0.773 |

|

Reputation of Director |

0.843 |

0.642 |

0.616 |

0.905 |

The data were analyzed by calculating the overall correlation between the constructs and the squared root of AVE, which should exceed the correlations between each construct and all other constructs, to find the study’s discriminant validity. The results in table 2 show the overall correlations among the variables were stable and the analysis of the squared root of AVE confirms satisfactory discriminant validity.

Table 2

Discriminant validity and correlations.

|

CU |

SN |

EM |

GOV |

SO |

CE |

AS |

PE |

CI |

RD |

|

|

CU |

0.692 |

|

||||||||

|

SN |

0.671 |

0.693 |

|

|||||||

|

EM |

0.606 |

0.673 |

0.773 |

|

||||||

|

GOV |

0.663 |

0.605 |

0.682 |

0.824 |

|

|||||

|

SO |

0.636 |

0.525 |

0.584 |

0.706 |

0.890 |

|

||||

|

CE |

0.656 |

0.565 |

0.618 |

0.635 |

0.636 |

0.796 |

|

|||

|

AS |

0.637 |

0.578 |

0.560 |

0.615 |

0.597 |

0.790 |

0.793 |

|

||

|

PE |

0.687 |

0.593 |

0.636 |

0.650 |

0.615 |

0.696 |

0.760 |

0.773 |

|

|

|

ID |

0.470 |

0.406 |

0.395 |

0.480 |

0.438 |

0.456 |

0.433 |

0.467 |

0.708 |

|

|

RD |

0.683 |

0.660 |

0.720 |

0.746 |

0.748 |

0.736 |

0.700 |

0.711 |

0.450 |

0.801 |

Note. SN = CSR to social and non-social stakeholders, EM = CSR to employees, CU = CSR to customers, GOV = CSR to government, SO = service offering, CE = contact personnel, AS = access to service, PE = physical environment, ID = corporate identity, RD = reputation of director.

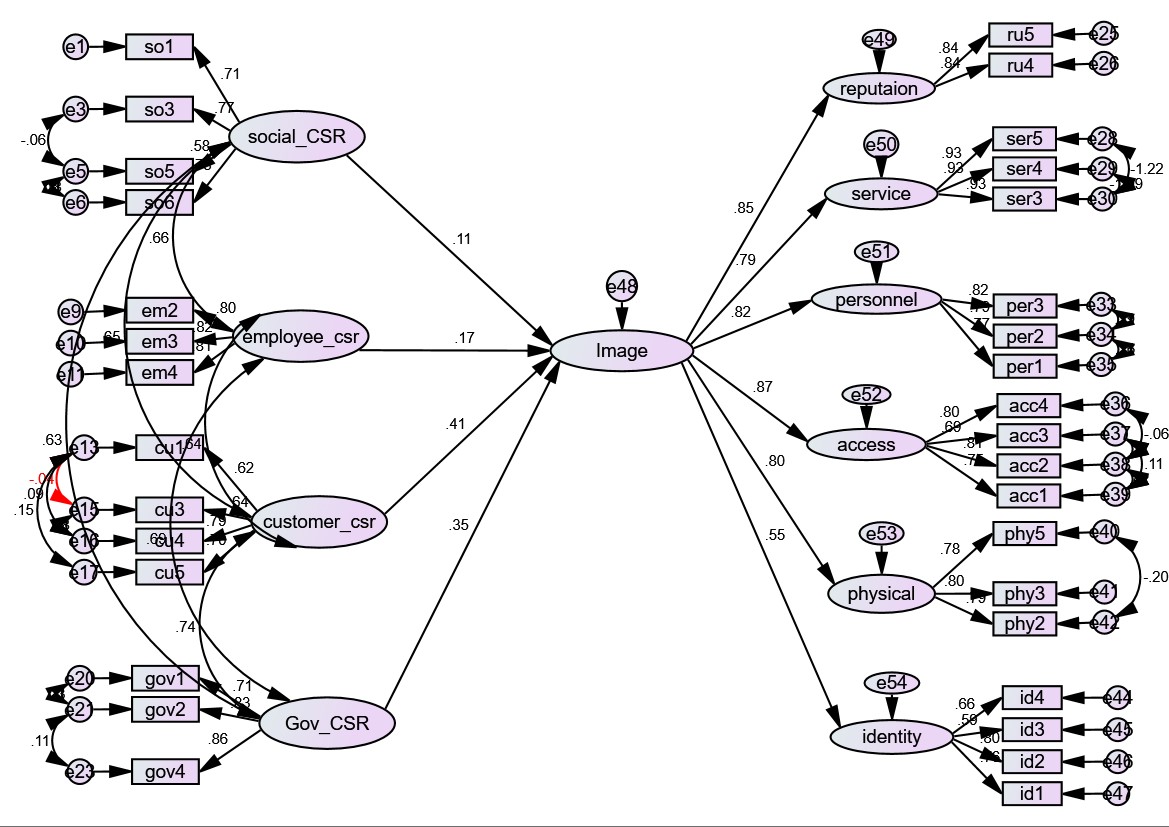

CFA was applied to test the theoretical model and hypothesis. In this study, CSR consisted of four factors with twenty-four items in total. In the final CFA model of CSR, all items were left to improve model fit indices and gain over the goodness-of-fit (GFI) of 0.9. CI consisted of six factors and twenty-six items. However, some CI items were removed to improve model fit indices, and only twenty-four items were left after getting over the GFI in the final CFA model for CI. The dependent and independent variables were measured through SEM using forty-eight items and second-order factor analysis for CI that included five factors. However, some items were removed to improve model fit indices, leaving thirty-three items, as shown in figure 1, after the 0.9 GFI. Fit indices of variables’ CFA and SEM are shown in table 3. The model fit was found acceptable up to the recommended level (Hair et al., 2010; Malhotra & Dash, 2016); the chi-square/df of CSR, CI and SEM were 1.412, 1.628 and 1.682 respectively, and the GFI of CSR, CI and SEM were 0.960, 0.957 and 0.922. The non-normed fit index (NNFI) of CSR, CI and SEM were 0.982, 0.982 and 0.968 respectively, and the comparative fit index (CFI) of CSR, CI and SEM were 0.989, 0.986 and 0.972, with the root mean square error of approximation (RMSEA) of CSR, CI and SEM at 0.027, 0.033 and 0.034 respectively.

Table 3

Fit indices of CFA for CSR, CI, and SEM.

|

Item |

CMIN (χ2) |

Degree of freedom (df) |

Probability level |

Χ2 / df |

GFI |

NNFI |

CFI |

RMSEA |

|

CSR |

295.133 |

209 |

0.000 |

1.412 |

0.960 |

0.982 |

0.989 |

0.027 |

|

CI |

288.186 |

177 |

0.000 |

1.628 |

0.957 |

0.982 |

0.986 |

0.033 |

|

SEM |

776.884 |

462 |

0.000 |

1.682 |

0.922 |

0.968 |

0.972 |

0.034 |

|

Fit Criteria |

- |

- |

- |

≤3 |

≥0.9 |

≥0.9 |

≥0.9 |

≤0.08 |

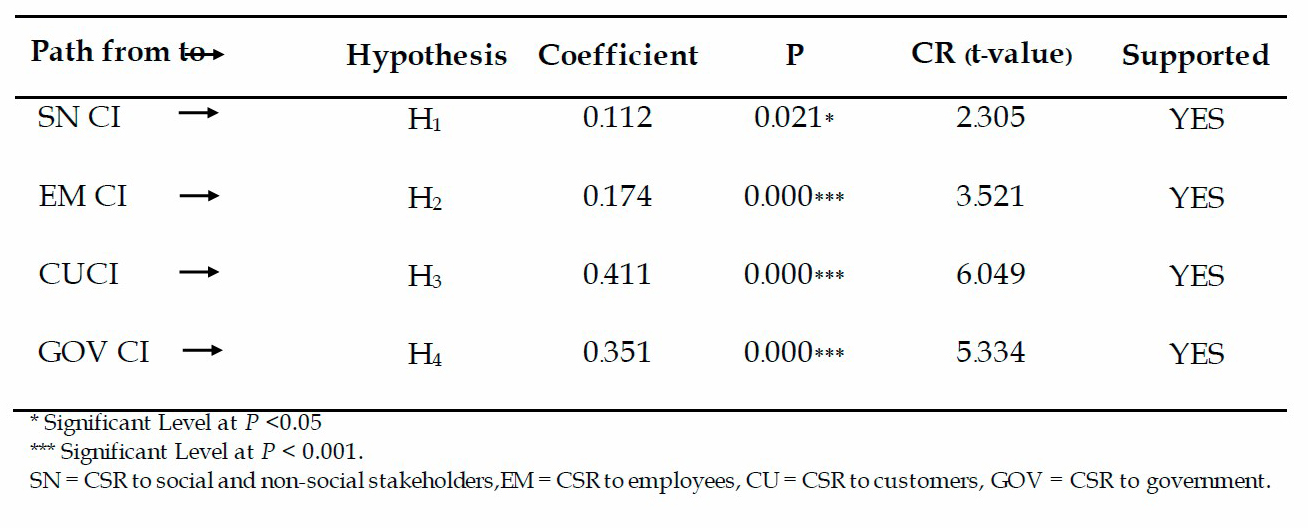

Table 4 tests of the four hypotheses with these factors according to the SEM analysis output. It indicates acceptance for all four hypothesized relationships. The standardized regression weights indicate that four hypotheses were significant in the hypothesized direction. The relationship between CSR to social and non-social stakeholders and CI (β=0.021; t-value=2.305; P <0.000), supports H1. The relationship between CSR to employees and CI (β=0.174; t-value=3.521; P <0.001) supports H2. The relationship between CSR to customers and CI (β=0.411; t-value=6.049; P <0.001) supports H3. The relationship between CSR to government and CI (β=0.351; t-value=5.334; P <0.001) supports H4.

Table 4

Hypothesis Testing.

Figure 1

Final model of SEM analysis.

DISCUSSION

As described in the analysis results, the study supported the theoretical model and all proposed hypotheses, indicating that all CSR dimensions were assumed to be strategic tools in formulating CI. On the other hand, CSR targeted at social and non-social stakeholders, employees, customers, and government were predictors of CI in the current study because the P-value of each hypothesis path was less than 0.05. Chang concluded that CSR was a significant issue for firms to run smoothly in the globalized, dynamic, and competitive business environment (2007). The more CSR activities a company engages in, the better their CI. The study’s findings are consistent with previous research in the banking context that showed a positive impact of bank CSR actions on CI (Mubarak et al., 2019; Dorota, 2016). Moreover, previous studies from different business contexts also found a positive relationship between CSR and CI (Gürlek et al., 2017; Jang & Kim, 2015; Kim et al., 2020; Maruf, 2013; Meechoobot & Rittippant, 2015), and their findings were in line with the results of this study.

Although all CSR dimensions in the study affected CI, CSR targeted at consumers was the strongest predictor of positive CI according to the hypothesis paths’ coefficient values. Customers preferred activities that could generate direct functional benefits for them over actions that could affect other stakeholders (McDonald & Hung Lai, 2011), and CI was consumers’ overall response to services provided by a firm (LeBlanc & Nguyen, 1996). CSR activities aimed at customers have a significant influence on their emotions and behavior (Yusof et al., 2015) and consequently positively affect CI.

Consumers tend to favor companies that follow the law, comply with regulations, and fully pay government taxes (Kim et al., 2020; Mubarak et al., 2019). Therefore, CSR aimed at government was the second strongest predictor of CI. According to Pradhan (2018), consumers believe that firms gain profit from the society they operate in and have a duty to give back to society through CSR activities. Observing how employees are affected is likely to affect consumers’ beliefs and intentions toward a firm or its brand (Maxwell-Smith et al., 2020). The level of customer satisfaction is affected by employee satisfaction (Jeon & Choi, 2012). For this reason, CSR aimed at employees is also a predictor of CI in the current study.

THEORETICAL CONTRIBUTION AND MANAGERIAL IMPLICATIONS

Although many previous studies focused on the relationship between CSR and CI, studies applying stakeholder theory are rare. Therefore, this study provides a significant theoretical contribution to the consumer behavior literature by exploring CSR’s impact on CI from a stakeholder perspective. Moreover, the study may also benefit studies of banking in developing countries by incorporating CSR and CI with consumer perception. Since all CSR factors positively affected CI, CSR should be used as a strategic tool to maintain and improve CI. Because CSR aimed at customers was the most influential kind, it is crucial to know customers’ needs and wants and fulfil them by providing a quick service offering, fair pricing, and an effective complaint handling system. CSR aimed at government, employees, and social and non-social stakeholders positively impacts CI too. Therefore, it is necessary to strictly follow rules and regulations and pay taxes and emphasize environmental action like recycling or reducing paper. It is also essential to perform social activities such as donations to a philanthropic organization or local community. It is also crucial to satisfy employees providing appropriate compensation and rewards.

LIMITATIONS AND FURTHER RESEARCH

Although the study has theoretical contributions and managerial implications, it also has a few limitations. The findings’ generalizations are limited because the study is focused on banking users from only one bank in Myanmar. The respondents’ perceptions reported in the current study may not represent other bank users. The other limitation is associated with the data collection method. In this study, data was collected by a non-probability sampling method. Lastly, this study uses the stakeholder CSR model to predict CI so its scope is limited. There may be other factors that could affect CI for banking users. Future research can expand its scope by adding more variables such as service quality and trust to better predict CI. Data can be collected from other private bank users to explore banking users’ perceptions in Myanmar. Although this research had some limitations, its results highlight some opportunities for Myanmar’s banking industry.

CONCLUSION

This study emphasizes exploring the relationship between stakeholder CSR and the CI held by banking customers in Myanmar. Results indicated that four dimensions of stakeholder CSR had a significant impact on CI. However, CSR to customers was the most influential of four CSR factors and reflects that banks must prioritize customers most. The study contributes to the consumer behavior literature on stakeholder CSR and CI perspective. Last, one significant contribution of this study is adding findings on bank customers’ attitudes toward stakeholder CSR and its impact on banks’ CI.

REFERENCES

Amaka, O. S. (2012). The role of corporate image management on bank’s performance: a comparative study of First Bank Plc and Union Bank Plc [Unpublished master’s dissertation]. University of Nigeria, Nsukka.

Anspach, R., & Lee, R. (1983). Shaping your bank’s corporate identity. Bank Marketing, 15(10), 20-30.

Arendt, S., & Brettel, M. (2010). Understanding the influence of corporate social responsibility on corporate identity, image, and firm performance. Management Decision, 48(10), 1469-1492. https://doi.org/10.1108/00251741011090289

Barkemeyer, R., & Miklian, J. (2019). Responsible business in fragile contexts: comparing perceptions from domestic and foreign firms in Myanmar. Sustainability, 11(3), 598. https://doi.org/10.3390/su11030598

Bednarska-Olejniczak, D. (2017). Corporate social responsibility as part of company image management in banking institutions. Oeconomia, 15(2), 5-14.

Bitner, M. J. (1992). Servicescapes: The Impact of Physical Surroundings on Customers and Employees. Journal of Marketing, 56(2), 57-71. https://doi.org/10.1177/002224299205600205

Carroll, A. B. (1979). A Three-Dimensional Conceptual Model of Corporate Performance. The Academy of Management Review, 4(4), 497-505.

Carroll, A. B. (1991). The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Business Horizons, 34(4), 39-48. https://doi.org/10.1016/0007-6813(91)90005-G

Chang, C. (2007). The relationships among corporate social responsibility, corporate image and economic performance of high-tech industries in Taiwan. Quality and Quantity, 43(3), 417. https://doi.org/10.1007/s11135-007-9117-z

Chen, C., Lin, S., Cheng, C., & Tsai, C. (2012). Service quality and corporate social responsibility, influence on post-purchase intentions of sheltered employment institutions. Research in Developmental Disabilities, 33(6), 1832-1840. https://doi.org/10.1016/j.ridd.2012.05.006

Crowther, D. S., & Shahla, S. (Eds.). (2021). The Palgrave Handbook of Corporate Social Responsibility. Palgrave Macmillan. https://doi.org/10.1007/978-3-030-42465-7

Decker, O. S. (2004). Corporate social responsibility and structural change in financial services. Managerial Auditing Journal, 19(6), 712-728.

Dorota, B. (2016). Corporate social responsibility as part of company image management in banking institutions. Oeconomia, 15(2), 5-14.

Dowling, G. R. (1993). Developing your company image into a corporate asset. Long Range Planning, 26(2), 101-109. https://doi.org/10.1016/0024-6301(93)90141-2

Downey, S. M. (1986). The relationship between corporate culture and corporate identity. Public Relations Quarterly, 31(4), 7-12.

Eells, R., & Walton, C. (1969). Conceptual Foundations of Business. Irwin.

Eiglier, P., & Langeard, E. (1987). Marketing des services. McGraw-Hill.

Evans, R. H. (1979). Bank selection: it all depends on the situation. Journal of Bank Research, 12(243), 242-247.

Fatma, M., Rahman, Z., & Khan, I. (2015). Building company reputation and brand equity through CSR: the mediating role of trust. International Journal of Bank Marketing, 33(6), 840-856.

Flavián, C., Guinalíu, M., & Torres, E. (2005). The influence of corporate image on consumer trust: A comparative analysis in traditional versus internet banking. Internet Research, 15(4), 447-470. https://doi.org/10.1108/10662240510615191

Flavián, C., Torres, E., & Guinalíu, M. (2004). Corporate image measurement: A further problem for the tangibilization of Internet banking services. International Journal of Bank Marketing, 22(5), 366-384. https://doi.org/10.1108/02652320410549665

Frederick, W. C., Davis, K., & Post, J. E. (1992). Business and Society: Corporate Strategy, Public Policy, Ethics. McGraw-Hill.

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Pitman.

Glaveli, N. (2020). Corporate social responsibility toward stakeholders and customer loyalty: investigating the roles of trust and customer identification with the company. Social Responsibility Journal, 17(3), 367-383. https://doi.org/10.1108/SRJ-07-2019-0257

Gürlek, M., Düzgün, E., & Uygur, S. M. (2017). How does corporate social responsibility create customer loyalty? The role of corporate image. Social Responsibility Journal, 13(3), 409-427. https://doi.org/10.1108/SRJ-10-2016-0177

Hair, J. F., Black, W. C., Babin, B. J., & Anderson, R. E. (2010). Multivariate Data Analysis: A Global Perspective. Pearson.

Hart, C. (1988, July). The Power of Unconditional Service Guarantees. Harvard Business Review, 66. https://hbr.org/1988/07/the-power-of-unconditional-service-guarantees

Herbig, P., Milewicz, J., & Golden, J. (1994). A model of reputation building and destruction. Journal of Business Research, 31(1), 23-31.

Heskett, J. L. (1987). Lessons in the service sector. Harvard Business Review, 65(2), 118-126.

Htin Lynn Aung. (2019, June 5). Consolidation expected in banking industry as competition heats up. Myanmar Times. https://www.mmtimes.com/news/ consolidation-expected-banking-industry-competition-heats.html

Jang, H., & Kim, S. (2015). Evaluating the Effect of the Corporate Social Responsibility (CSR) on Corporate Image and Reputation in the Shipping Sector. Journal of Navigation and Port Research, 39(5), 401-408. https://doi.org/10.5394/KINPR.2015.39.5.401

Jeon, H., & Choi, B. (2012). The relationship between employee satisfaction and customer satisfaction. Journal of Services Marketing, 26(5), 332-341. https://doi.org/10.1108/08876041211245236

Kant, R., Jaiswal, D., & Mishra, S. (2017). The Investigation of Service Quality Dimensions, Customer Satisfaction and Corporate Image in Indian Public Sector Banks: An Application of Structural Equation Model (SEM). Vision, 21(1), 76-85. https://doi.org/10.1177/0972262916681256

Kim, M., Yin, X., & Lee, G. (2020). The effect of CSR on corporate image, customer citizenship behaviors, and customers’ long-term relationship orientation. International Journal of Hospitality Management, 88, 102520. https://doi.org/10.1016/j.ijhm.2020.102520

Kotler, P., & Lee, N. (2004). Corporate Social Responsibility: Doing the Most Good for Your Company and Your Cause. John Wiley & Sons.

LeBlanc, G., & Nguyen, N. (1996). Cues used by customers evaluating corporate image in service firms: An empirical study in financial institutions. International Journal of Service Industry Management, 7(2), 44-56. https://doi.org/10.1108/09564239610113460

Lee, C. Y. (2019). Does Corporate Social Responsibility Influence Customer Loyalty in the Taiwan Insurance Sector? The role of Corporate Image and Customer Satisfaction. Journal of Promotion Management, 25(1), 43-64. https://doi.org/10.1080/10496491.2018.1427651

Lee, S. S., Kim, Y., & Roh, T. (2019). Modified pyramid of CSR for corporate image and customer loyalty: Focusing on the moderating role of the CSR experience. Sustainability, 11(17), 1-21.

Maignan, I., Ferrell, O. C., & Hult, G. T. M. (1999). Corporate citizenship: Cultural antecedents and business benefits. Journal of the Academy of Marketing Science, 27(4), 455-469. https://doi.org/10.1177/0092070399274005

Malhotra, N. K., & Dash, S. A. (2016). Marketing research : an applied orientation. New Delhi: Pearson Education.

Malhotra, N. K., Nunan, D., & Birks, D. F. (2017). Marketing Research: an Applied Approach. Pearson Education.

Mandel, L., Lachman, R., & Orgler, Y. (1981). Interpreting the image of banking. Journal of Bank Research, 12(2), 96-104.

Maruf, A. A. (2013). Corporate social responsibility and corporate image. Transnational Journal of Science and Technology, 3(8), 29-49.

Maxwell-Smith, M. A., Barnett White, T., & Loyd, D. L. (2020). Does perceived treatment of unfamiliar employees affect consumer brand attitudes? Social dominance ideologies reveal who cares the most and why. Journal of Business Research, 109, 461-471. https://doi.org/10.1016/j.jbusres.2019.12.039

McDonald, L. M., & Hung Lai, C. (2011). Impact of corporate social responsibility initiatives on Taiwanese banking customers. International Journal of Bank Marketing, 29(1), 50-63.

Meechoobot, K., & Rittippant, N. (2015). The effect of consumer’s personality and CSR activities on customer’s perception, perceived motive, corporate image, and purchase intention: a case study on petroleum companies in Thailand. NIDA Development Journal, 55(4), 59-121.

Minyin, Z. (2018). Myanmar’s Top 4 Companies for Sustainability and CSR. https://www.prospectsasean.com/myanmar-top-4-companies-for-sustainability-csr/

Moisescu, O. (2017). From CSR to customer loyalty: An empirical investigation in the retail banking industry of a developing country. Scientific Annals of Economics and Business, 64(3), 307-323. https://doi.org/10.1515/saeb-2017-0020

Mubarak, Z. A., Hamed, A. B., & Mubarak, M. A. (2019). Impact of corporate social responsibility on bank’s corporate image. Social Responsibility Journal, 15(5), 710-722.

Mukonza, C., & Swarts, I. (2020). The influence of green marketing strategies on business performance and corporate image in the retail sector. Business Strategy and the Environment, 29(3), 838-845. https://doi.org/10.1002/bse.2401

Nguyen, N. (2006). The Perceived Image of Service Cooperatives: An Investigation in Canada and Mexico. Corporate Reputation Review, 9(1), 62-78. https://doi.org/10.1057/palgrave.crr.1550010

Öberseder, M., Schlegelmilch, B. B., Murphy, P. E., & Gruber, V. (2014). Consumers’ Perceptions of Corporate Social Responsibility: Scale Development and Validation. Journal of Business Ethics, 124(1), 101-115. https://doi.org/10.1007/s10551-013-1787-y

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1988). SERVQUAL: A multiple-item scale for measuring consumer perceptions of service quality. Journal of Retailing, 64(1), 12-40.

Pomering, A., & Dolnicar, S. (2009). Assessing the Prerequisite of Successful CSR Implementation: Are Consumers Aware of CSR Initiatives? Journal of Business Ethics, 85(2), 285-301. https://doi.org/10.1007/s10551-008-9729-9

Porter, M. E., & Kramer, M. R. (2006). The link between competitive advantage and corporate social responsibility. Harvard Business Review, 84(12), 78-92.

Pradhan, S. (2018). Role of CSR in the consumer decision making process – The case of India. Social Responsibility Journal, 14(1), 138-158. https://doi.org/10.1108/SRJ-06-2016-0109

Salai Tun Tun. (2020, September 29). Banking on a cardless future. Myanmar Times. https://www.mmtimes.com/news/myanmar-sees-digital-payment-growth-2020-obg.html

Semnani, B. L., Maymand, M. M., Dehkordi, L. F., & Fard, R. S. (2015). Effect of Employee Branding on Customer Satisfaction, Favorable Reputation and Employee Satisfaction. International Journal of Asian Social Science, 5(3), 140-155.

Sen, S., & Bhattacharya, C. B. (2001). Does Doing Good Always Lead to Doing Better? Consumer Reactions to Corporate Social Responsibility. Journal of Marketing Research, 38(2), 225-243.

Servaes, H., & Tamayo, A. (2013). The Impact of Corporate Social Responsibility on Firm Value: The Role of Customer Awareness. Management Science, 59(5), 1045-1061.

Sherril, H. K. (1977). Nurturing Corporate Images. European Journal of Marketing, 11(3), 119-164. https://doi.org/10.1108/EUM0000000005007

Stanaland, A. J. S., Lwin, M. O., & Murphy, P. E. (2011). Consumer Perceptions of the Antecedents and Consequencesof Corporate Social Responsibility. Journal of Business Ethics, 102(1), 47-55.

Taylor, S. (1994). Waiting for Service: The Relationship between Delays and Evaluations of Service. Journal of Marketing, 58(2), 56-69. https://doi.org/10.2307/1252269

Turker, D. (2009). Measuring Corporate Social Responsibility: A Scale Development Study. Journal of Business Ethics, 85(4), 411-427. https://doi.org/10.1007/s10551-008-9780-6

Wagner, T., Bicen, P., & Zachary, R. H. (2008). The dark side of retailing: towards a scale of corporate social irresponsibility. International Journal of Retail & Distribution Management, 36(2), 124-142. https://doi.org/10.1108/09590550810853075

Wang, C. (2020). Corporate social responsibility on customer behaviour: the mediating role of corporate image and customer satisfaction. Total Quality Management & Business Excellence, 31(7-8), 742-760. https://doi.org/10.1080/14783363.2018.1444985

Werther, W. B., & Chandler, D. B. (2010). Strategic Corporate Social Responsibility: Stakeholders in a Global Environment. Sage.

Worcester, R. (1997). Managing the image of your bank: the glue that binds. International Journal of Bank Marketing, 15(5), 146-152. https://doi.org/10.1108/02652329710175244

Worcester, R. (2009). Reflections on corporate reputations. Management Decision, 47(4), 573-589.

Yadav, R., Dokania, A. K., & Swaroop Pathak, G. (2016). The influence of green marketing functions in building corporate image. International Journal of Contemporary Hospitality Management, 28(10), 2178-2196. https://doi.org/10.1108/IJCHM-05-2015-0233

Yavas, U., Benkenstein, M., & Stuhldreier, U. (2004). Relationships between service quality and behavioral outcomes: A study of private bank customers in Germany. International Journal of Bank Marketing, 22(2), 144-157. https://doi.org/10.1108/02652320410521737

Yusof, J. M., Manan, H. A., Karim, N. A., & Kassim, N. A. M. (2015). Customer’s Loyalty Effects of CSR Initiatives. Procedia - Social and Behavioral Sciences, 170, 109-119. https://doi.org/10.1016/j.sbspro.2015.01.020

Zhang, J., & Cui Yu, H. (2018). Fashion Corporate Social Responsibility, Corporate Image, Product Preference, and Purchase Intention: Chinese Consumers’ Perspectives. The Korean Society of Fashion Business, 22(6), 14-24. https://doi.org/10.12940/JFB.2018.22.6.14

Zikmund, W. G. (2010). Business Research Methods. South-Western Cengage Learning.

Appendix 1

Measurement scale items – stakeholder CSR and corporate image.

|

Variables |

Scale items |

|

CSR to Social and Non-social Stakeholders |

The Bank participates in the activities which aim to protect and improve the quality of the natural environment. |

|

The Bank implements special programs to minimize its negative impact on the natural environment. |

|

|

The Bank invests in creating a better life for future generations. |

|

|

The Bank targets sustainable growth, which considers the future generations. |

|

|

The Bank supports non-governmental organizations working in the necessary areas. |

|

|

The Bank contributes to the campaigns that promote the wellbeing of society. |

|

|

The Bank encourages its employees to participate in voluntary activities. |

|

|

CSR to Employees |

The Bank’s policies encourage employees to develop their skills and careers. |

|

The management of the Bank take consideration of Employees’ needs and wants. |

|

|

The Bank implements flexible policies to provide good work life balance for its employees. |

|

|

The Bank managerial decisions related to employees are usually fair. |

|

|

The Bank supports employees’ further study. |

|

|

CSR to Customers

|

Customer satisfaction is highly important for the Bank. |

|

The Bank strives to offer financial services of reasonable quality. |

|

|

The Bank charges fair and reasonable prices for its financial services. |

|

|

The Bank provides safe financial services, not-threatening to physical/ mental health. |

|

|

The Bank establishes procedures to comply with customer complaints. |

|

|

CSR to Governments |

The Bank pays its taxes regularly. |

|

The Bank complies with legal regulations completely and promptly. |

|

|

The Bank offers financial services according to laws and regulations. |

|

|

The Bank always honors contractual obligations. |

|

|

The managers of the Bank try to comply with the law. |

|

|

Reputations of Directors |

The directors of the Bank have a good reputation. |

|

The manner in which the Bank is directed is proper. |

|

|

Dealings with the directors of the Bank are confidential. |

|

|

The directors of the Bank provide great benefit for customers. |

|

|

The directors’ actions of the bank are credible. |

|

|

Service Offering

|

The Bank provides a variety of financial services. |

|

The Bank uses technology to provide financial services.. |

|

|

The Bank’s procedures to provide financial services are appropriate. |

|

|

The financial transactions of the Bank are secure. |

|

|

The financial services of the Bank are reliable. |

|

|

Corporate Identity |

The name of the Bank is recognizable. |

|

The logo of the Bank is recognizable. |

|

|

The Bank has distinctive features. |

|

|

The advertising of the Bank is attractive. |

|

|

Contract Personnel |

The staff of the Bank are friendly and courteous. |

|

The staff of the Bank are competent. |

|

|

The staff of the Bank are knowledgeable. |

|

|

The Bank’s staff are good-looking. |

|

|

The staff of the Bank can give financial advice. |

|

|

Access to Service |

The waiting time for the financial services of the Bank is appropriate. |

|

The waiting time for appointments with Bank staff is appropriate. |

|

|

The operating time of the Bank is convenient. |

|

|

Making complaints is possible at the Bank. |

|

|

The services of the Bank are easy to use. |

|

|

Physical Environment |

Parking facilities of the Bank are secure. |

|

The appearance of the building is impressive. |

|

|

The decor and atmosphere of the Bank are pleasant. |

|

|

The layout of the Bank is systematic. |

|

|

The lighting of the Bank is appropriate. |